Designing Your Portuguese Home with NHR Tax Regime Benefits in Mind

Designing Your Portuguese Home with NHR Benefits in Mind

Portugal has been on the forefront programs that can attract foreign investors into its economy for the past decade(s). This was mostly through two specific programs. One considered as the Portugal investment visa, also known as “golden visa”, and the other the Non-Habitual Resident (NHR) tax regime has been a cornerstone of the nation’s appeal to foreign professionals, retirees, and investors for over a decade. Introduced as a strategic move to boost the Portuguese economy, the NHR regime offered a range of generous tax exemptions and benefits, making Portugal an attractive destination for those seeking tax-efficient residency in Europe.

This regime, combined with the country’s allure, makes it an ideal place to design your dream home. In this article, we’ll delve into the intricacies of the NHR tax regime and how it can influence your home design choices in Portugal.

The Intersection of Home Design and Tax Benefits

With the NHR tax regime in place, many individuals find themselves with extra disposable income. This financial flexibility can be channeled into creating a home that truly reflects one’s personal style and the rich tapestry of Portuguese culture.

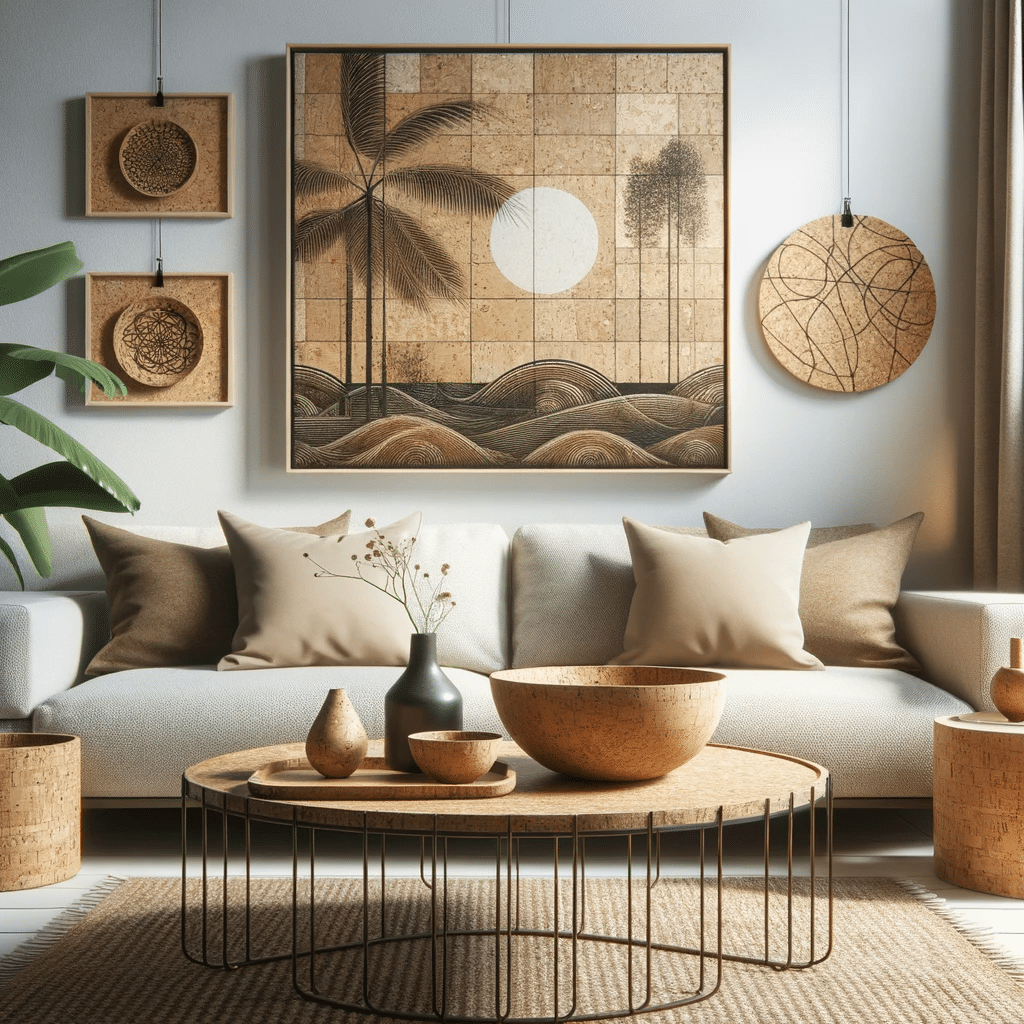

Incorporating Portuguese Aesthetics with Modern Design

Portugal’s architectural and design heritage is vast. From the traditional azulejos (tiles) to modern minimalist designs, there’s a wealth of inspiration to draw from. With the tax advantages from the regime, homeowners can invest in authentic Portuguese decor elements, blending them seamlessly with contemporary designs.

The NHR Regime and the Broader Portuguese Lifestyle

The Non-Habitual Resident (NHR) tax regime has been one of Portugal’s most enticing offerings for expatriates and global citizens. Introduced in 2009, the NHR regime was designed to attract skilled professionals foreign investors, high-net-worth individuals, and retirees to Portugal by offering significant tax advantages.

While the NHR tax regime offers undeniable financial benefits, it’s essential to understand its role within the broader Portuguese lifestyle.

Embracing the Portuguese Way of Life

Being a tax resident in Portugal under the NHR status means more than just enjoying tax benefits. It’s about immersing oneself in the rich tapestry of Portuguese culture, from its culinary delights to its vibrant festivals. The wealth tax savings from the NHR regime can be used to explore the country, learn its language, and truly become a part of its community.

The NHR regime’s primary allure was the substantial tax exemptions it provided on specific income types. For retirees, this meant enjoying their pensions without the burden of heavy taxation. For professionals and digital nomads, the regime presented an opportunity to work in a beautiful country and pay tax, while benefiting from tax breaks on their own income earned from foreign-sourced income. Entrepreneurs and investors, too, were drawn to Portugal, seeing the potential for growth and innovation in a tax-friendly environment.

However, as with many policies that gain popularity, the NHR regime began to face scrutiny. Critics argued that while it brought economic benefits, it also contributed to rising property prices, especially in popular cities like Lisbon and Porto. This surge in property demand and prices made housing less affordable for locals, leading to debates on the regime’s long-term sustainability.

End of the NHR Tax Relief Era

All good things must come to an end. The Prime Minister recently announced that the special tax for new non-habitual residents would conclude in 2024. There are still some uncertainties about it at this point, so if you are interested in it, there are some resources about the NHR Portugal, like this one that guide you specifically on the latest developments on it.

This decision was based on the belief that the NHR regime had already served its purpose and was no longer justified, especially considering its impact on the housing market, which saw inflated prices. The Prime Minister emphasized that those already benefiting from the regime would continue to do so, but no new applications would be accepted after 2024.

The recent announcement by the Prime Minister marked a significant shift in Portugal’s approach to attracting foreign residents. The decision to conclude the special tax status for new non-habitual residents by 2024 was met with mixed reactions. While some saw it as a necessary move to the tax burden and address the housing market’s challenges, others felt it might deter potential expatriates from choosing Portugal as their new home.

The news of the NHR regime’s impending end has not only impacted potential expatriates but has also caught the attention of neighboring countries. Spain, for instance, is positioning itself as an attractive alternative, ready to welcome those who might have previously considered Portugal.

Spain’s Response to the End of NHR in Portugal

While the end of the NHR tax status regime in Portugal has caused ripples of concern among potential expatriates, neighboring Spain sees an opportunity. Spain is gearing up to introduce a new tax relief regime for former residents, aiming to attract those who might have previously considered Portugal. Real Estate Consulting and Valuation companies have expressed skepticism that ending the NHR tax exempt regime will address Portugal’s housing crisis. However, Spain is keen on capitalizing on this change, promoting its program as a competitive alternative to Portugal’s NHR.

Real Stories – The NHR and Family Considerations

For those considering moving their family members to Portugal, the NHR regime used to offer additional incentives. From tax exemptions on global income to potential tax breaks for family-run businesses, the NHR tax residence ensures that the entire family can benefit from Portugal’s generous tax policies.

Clara’s Journey: Embracing the Portuguese Dream

Clara, a retired schoolteacher from Canada, had always dreamt of living by the sea. When she learned about the NHR in Portugal, she saw it as a sign. With the tax benefit and exemptions on her pension income, she could comfortably relocate without financial strain. After moving to the Algarve region, Clara used her savings from the NHR tax benefits to buy a quaint cottage overlooking the ocean. Inspired by the local architecture, she blended traditional Portuguese design elements with her own personal style. The azulejos in her kitchen told stories of her travels, while the modern furniture spoke of her contemporary taste.

Raj’s Tech Adventure: From Silicon Valley to Lisbon

Raj, a tech entrepreneur from Silicon Valley, was on the lookout for a new base for his startup. Drawn by Portugal’s burgeoning tech scene and the regime, he decided to make the leap to Lisbon. The various tax rates and exemptions on foreign source income meant that his earnings from the U.S. would be significantly reduced, allowing him to invest more in his Portuguese venture. He rented a loft in a historic Lisbon neighborhood, where the juxtaposition of the ancient and modern mirrored his life. His home became a blend of sleek, minimalist design with touches of Portuguese craftsmanship.

The Garcias: A Family Affair in Portugal

The Garcia family, originally from Argentina, had been globetrotters. But when they discovered the NHR, they decided it was time to set down roots. The flat tax rate and benefits, especially for family members, made Portugal an attractive choice. They purchased a villa in Porto, where the river’s serenity and the city’s buzz became a daily backdrop. Their home was a blend of vibrant Latin American colors with Portuguese design sensibilities. Each room told a story, from the kids’ rooms adorned with patterns inspired by Portuguese tales to the living room that echoed the family’s love for music.

Reflecting on the NHR Legacy and Looking Ahead

The Non-Habitual Resident regime has undeniably left an indelible mark on Portugal’s socio-economic landscape. Over the years, it has transformed the lives of countless families, including those of Clara, Raj, and the Garcias, whose stories we’ve shared. These individuals, like many others, were drawn to Portugal’s shores, not just by its scenic beauty and rich culture, but by the promise of a tax regime that offered them financial breathing space and a chance to rebuild their lives.

For retirees, the NHR was a beacon of hope, paying tax and allowing them to enjoy their golden years without the looming shadow of hefty taxes. For professionals, it was an opportunity to merge work and leisure in a country that offered both tax breaks and a high quality of life. Entrepreneurs and investors found in Portugal a fertile ground for innovation and growth, all under the umbrella of the NHR’s tax-friendly policies.

Benefits of the NHR in Portugal

The NHR regime offered a plethora of benefits:

- Tax Exemptions: Foreign-source income, including pensions, dividends, and royalties, were often exempt from taxation.

- Reduced Tax Rates: Certain types of Portuguese-source income were taxed at a flat rate, making it favorable for professionals and entrepreneurs.

- No Wealth or Inheritance Tax: This was particularly attractive for retirees and those looking to pass on assets to the next generation.

- Double Taxation Agreements: Portugal’s extensive network of double taxation treaties ensured that individuals weren’t taxed twice on the same income.

Advantages of the NHR status

Beyond the fiscal benefits, the NHR status brought several other advantages:

- Lifestyle: Portugal’s mild climate, rich history, and vibrant culture made it a top destination for expats.

- Safety: Portugal is consistently ranked as one of the safest countries in the world.

- Healthcare: The country boasts a robust healthcare system, accessible to all residents.

- Education: Portugal’s focus on education and its array of international schools made it ideal for families.

However, as the sun sets on the NHR regime, there’s a palpable air of uncertainty. The decision to phase out the NHR by 2024 has been met with mixed reactions. While some view it as a necessary step to recalibrate Portugal’s housing market and ensure affordability for locals, others worry about the potential decline in foreign investment and the allure for expatriates.

In this changing landscape of tax havens, Spain emerges as a potential successor to Portugal’s NHR legacy. With its eyes set on attracting the same demographic that once flocked to Portugal, Spain is gearing up to offer competitive tax incentives. As the end of the NHR era in Portugal approaches, Spain’s proactive stance might just be the beginning of a new chapter for expatriates seeking tax-efficient residency in Europe.

In conclusion, while the NHR regime’s chapter in Portugal’s history might be drawing to a close, its legacy will live on in the stories of the families it impacted and the economic growth it spurred. As one door closes, another opens, and it remains to be seen how Spain will take the baton forward in this race to attract global citizens.

FAQs on the NHR Regime in Portugal:

How do you qualify for NHR in Portugal?

It was designed for individuals who have not been tax residents in Portugal for the previous five years. Applicants must also spend a minimum of 183 days in Portugal during the tax year.

Is NHR still available in Portugal?

Yes, to apply for the NHR and regime is still available for those who are already benefiting from it. However, the Portuguese government has announced that no new applications will be accepted after 2024.

What is the tax exemption for NHR in Portugal?

The NHR regime offers tax exemptions on certain types of income, including pensions, dividends, capital gains, taxable income and royalties.

Is there no income tax in Portugal for 10 years?

The NHR regime provides tax benefits for a period of 10 years. However, it’s essential to note that not all income types are exempt from double taxation either.