What Home Improvements Increase Property Taxes?

Thinking about fixing up your home? Before you grab that hammer or call a contractor, there’s something you should know.

Those awesome changes might make your house look better, but they could also make your tax bill bigger. It’s a surprise many homeowners don’t see coming until that new bill arrives.

From adding a spare bedroom to putting in that backyard pool you’ve always wanted, certain improvements catch the tax assessor’s eye.

But don’t worry – not every update will cost you extra in taxes.

In this guide, we’ll walk through which projects typically raise your property taxes and which ones fly under the radar. A little knowledge now might save you from a tax shock later.

Relationship Between Home Improvements and Property Tax

When you fix up your home, you might not think about how it affects your taxes. But many improvements can raise your property tax bill.

Let’s look at how this works and what you need to know before starting your next home project.

How Property Taxes are Calculated

Your property tax bill comes from two main factors: your home’s assessed value and your local tax rate (called the mill rate). When you make improvements that increase your home’s value, your tax bill typically goes up, too.

The exact amount depends on your local government’s rules for assessing property. Some areas update values yearly, while others do it less often.

Your home’s value is compared to similar homes in your area to ensure a fair and accurate assessment.

How Assessors Learn About Your Renovations

Tax assessors find out about your home improvements in several ways.

- When you get building permits, this alerts them to your project.

- They also do regular property checks in neighborhoods.

- When homes sell nearby, they compare prices to spot improvements.

- Many areas also use aerial photos to spot new additions. Some counties even have teams that drive around looking for changes to homes.

If you sell your house, the new assessment often happens right away, showing all the updates you’ve made over time.

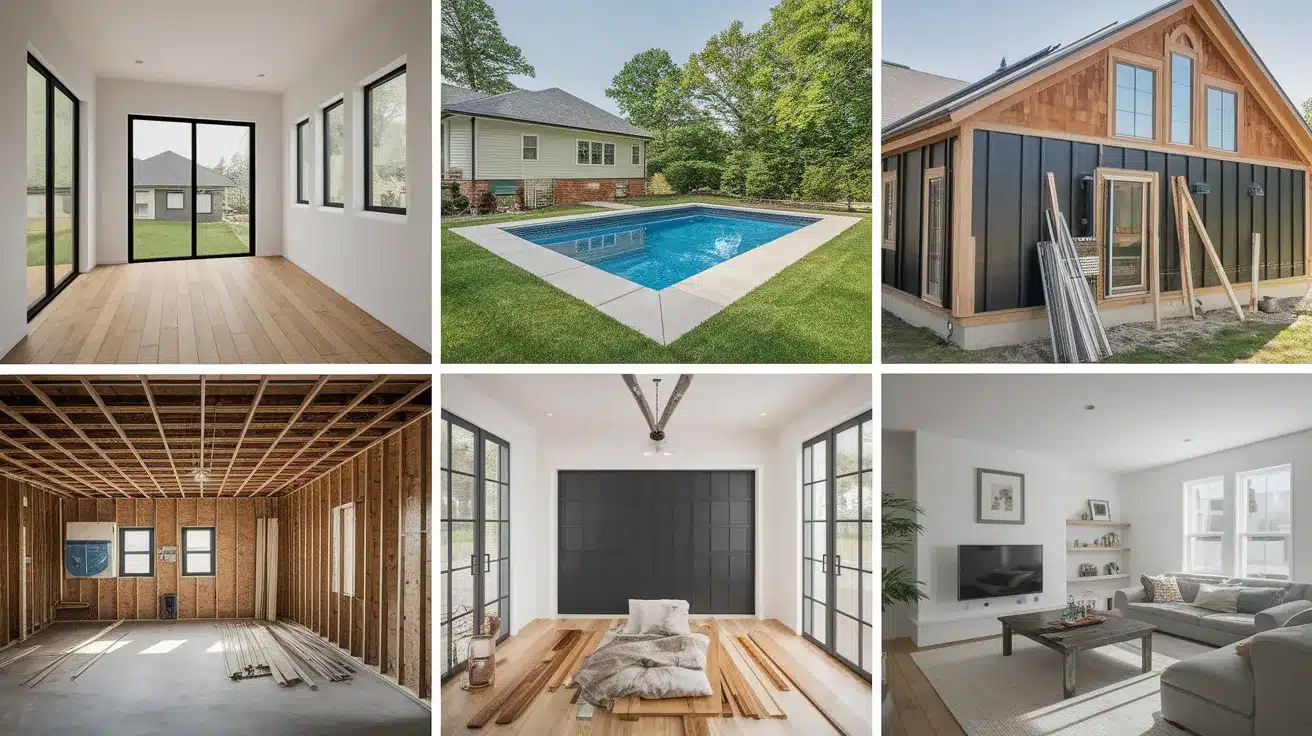

Home Improvements That Usually Raise Property Taxes

When you’re planning to spruce up your home, it’s good to know how it might hit your wallet beyond just the cost of the work. Some changes to your house can bump up your property taxes, while others won’t.

Let us walk you through what typically catches the tax assessor’s eye and what flies under the radar.

1. Major Additions and Structural Changes

Adding a new room or second story: When you build extra space in your home, like a new bedroom or an entire upper floor, your home’s value goes up significantly. This bigger footprint means more living space.

Tax assessors see it as added value worthy of higher taxes.

Building a garage or attached sunroom: A new garage gives you covered parking and storage space that adds clear value to your property. Similarly, a sunroom adds year-round living space with lots of natural light.

Both are features that assessors count when figuring your home’s worth.

Installing an in-ground pool or hot tub: A permanent pool or hot tub is seen as a luxury feature that makes your property more valuable. These water features require permits and are easily spotted during assessments.

Such additions will almost always lead to higher property taxes.

Finishing a basement or attic: Taking unused space and making it into living areas adds to your home’s square footage. When you turn that dusty attic or concrete basement into bedrooms, offices, or recreation rooms, you’re adding taxable value to your home.

2. Converting and Expanding Spaces

Turning a porch or patio into livable space: When you enclose an open area and add heating, cooling, and proper walls, you’re creating new living space. This change transforms what was seasonal outdoor space into year-round usable rooms.

These are all changes, not just to your home but also to your home’s assessed value.

Converting a garage into a bedroom: Changing your garage from car storage to a bedroom adds to your home’s livable square footage. You’re using existing space to better your home.

However, the change in function from storage to living area usually triggers a new, higher assessment.

Adding more bathrooms: Extra bathrooms make daily life easier and add significant value to your home. Each new bathroom typically adds 10-20% to your home’s value.

This means tax assessors take notice and adjust your property taxes accordingly.

3. Luxurious and High-End Upgrades

Spa-style bathrooms: When you upgrade to fancy showers, soaking tubs, and double sinks, you’re adding features that buyers love.

These bathroom makeovers stand out during assessments. They transform basic spaces into luxury ones, often leading to higher taxes.

Gourmet kitchens with high-end finishes: Kitchens sell homes, and fancy ones with stone counters, custom cabinets, and top-notch appliances boost your home’s value.

These upgrades are easy for assessors to spot and often lead to significant increases in your property’s assessed value.

Upscale landscaping and outdoor kitchens: Elaborate outdoor living areas with built-in grills, fire pits, and fancy plantings add to your property’s curb appeal and functionality.

These permanent outdoor features are viewed as extensions of your living space and typically raise your assessment.

4. Permanent Outdoor Structure

Decks and patios (especially permanent ones): Large, well-built outdoor living spaces add value that assessors notice. A sturdy deck or stone patio extends your living area outdoors and typically requires permits.

These permits make these improvements visible to tax authorities.

Large sheds or workshops: When you build sizable outbuildings for hobbies, storage, or work, you’re adding usable space to your property. These structures have electricity, plumbing, and upgrades.

All of this counts as valuable additions that often trigger tax increases.

Fencing, driveways, and paving dirt paths: Turning rough areas into finished ones improves your property’s function and appearance. New concrete driveways, brick paths, or quality fencing all improve your property’s overall condition.

Assessors factor it all into your home’s value.

5. Energy-Efficient Upgrades

Solar panels: While these save on electric bills and might qualify for tax credits, they’re still a valuable addition to your property. The panels themselves are costly improvements that make your home more self-sufficient.

This can increase its assessed value despite the green benefits.

Geothermal systems: These earth-friendly heating and cooling systems cost a lot upfront but save money long-term.

Tax assessors see them as premium features that make your home more valuable, even though they might qualify for energy tax breaks in some places.

High-efficiency windows and HVAC systems: Better windows and modern heating/cooling equipment make your home more comfortable and cut energy costs.

While you might get rebates for installing them, these upgrades still improve your home’s quality and can lead to higher assessed values.

6. Historical Home Restorations

Restoring historic features: Bringing back original details like crown molding, hardwood floors, or stained glass adds charm and authenticity to older homes.

These careful restorations take skill and money, adding value that tax assessors notice during their reviews.

Home Improvements Less Likely to Affect Taxes

Not every change to your home will hit your wallet twice. Some projects keep your house in good shape or make it look better without raising red flags for the tax assessor.

Here’s what you can typically do without worrying about a tax hike.

Minor or Cosmetic Changes

Interior/exterior painting: Fresh paint makes your home look clean and new, but it’s considered basic maintenance. Just in case you’re touching up your living room walls or giving your home’s exterior a whole new color.

Paint jobs rarely catch an assessor’s attention since they don’t add actual value or square footage.

New flooring or cabinetry: Replacing worn carpets with hardwood or updating old cabinets refreshes your space without changing its function. These cosmetic upgrades are viewed as normal upkeep.

This maintains your home’s existing value rather than improvements that add new value worthy of reassessment.

Removing non-load-bearing walls: Opening up your floor plan by taking out walls between rooms can make your space feel bigger. But, it doesn’t add any actual square footage.

Since you’re working within your existing space and not adding structural elements, assessors typically don’t see this as increasing your property’s taxable value.

Appliance upgrades: Swapping out your old fridge or dishwasher for newer models falls under normal home maintenance. These items are considered personal property rather than permanent fixtures.

So, even fancy new appliances generally won’t trigger a new tax assessment or raise your property taxes.

Routine Maintenance

Roof replacement: Putting on a new roof is expensive but necessary to protect your home from damage. Even if you upgrade to better materials, you’re typically just keeping your home in good working order.

Tax assessors view this as maintaining your home’s current condition rather than improving it.

Plumbing or electrical repairs: Fixing leaky pipes or updating old wiring keeps your home safe and functional. These behind-the-walls improvements maintain your home’s systems rather than adding features.

They rarely cause tax increases, even though they’re important for your home’s overall health.

Landscaping refresh: Basic yard work like planting flowers, trimming trees, or adding mulch improves your home’s look without adding permanent structures.

Simple landscaping is seen as regular upkeep that maintains your property’s existing condition rather than an improvement that increases its assessed value.

Navigating Property Tax Impacts

Nobody likes surprise tax bills. Before you start knocking down walls or building that dream deck, it’s smart to think about how your plans might affect what you’ll owe each year.

A little homework now can save you from tax shock later.

Tips for Planning Renovations

Here are some important tips to keep in mind when you’re planning for additions to your home so your tax bill doesn’t shock you.

- Check with your local tax office before starting big projects. They can tell you if your plans might trigger a new assessment.

- Sometimes, doing work in phases can spread out any tax increases.

- Remember that permits alert assessors, but skipping them can cause bigger headaches later.

- Think about the joy a renovation brings versus its cost—including any tax bump.

- You might also want to time your projects around assessment cycles. Many areas only review property values every few years, so planning work just after an assessment could give you time to enjoy improvements before taxes rise.

- Talk to neighbors who’ve done similar work to hear about their tax experiences.

How Much Will My Property Taxes Increase?

|

Home Improvement |

Typical Annual Property Tax Increase (Approx.) |

|

Adding a room / Second story |

$300 – $1,600+ per year |

|

New garage |

$70 – $460 per year |

|

In-ground pool |

$200 – $320 per year |

|

Finished basement |

$400 – $600 per year |

|

Converted porch/patio |

$100 – $300 per year |

|

Garage to bedroom conversion |

$300 – $500 per year |

|

Extra bathroom |

$200 – $400 per year |

|

Spa bathroom |

$180 – $400 per year |

|

Gourmet kitchen |

$500 – $800 per year |

|

Outdoor kitchen |

$50 – $200 per year |

|

Large deck/patio |

$140 – $160 per year |

|

Workshop/large shed |

$0 – $50 per year |

|

New driveway/fencing |

$20 – $70 per year |

|

Solar panels |

$0 – $150 per year |

|

Geothermal system |

$0 – $150 per year |

|

Historic restoration |

$0 – $1,000 per year |

Conclusion

Making smart choices about home improvements means thinking about more than just how they’ll look or work. You also need to consider their impact on your taxes.

We’ve seen that major additions like rooms and pools almost always raise your tax bill, while simple updates like painting or fixing your roof typically don’t.

The good news? You can still make your home better without spending a fortune on taxes.

You can manage the tax hit by planning carefully, checking local rules, and maybe timing your projects around assessment cycles. Remember, a good renovation adds more value and joy than it costs in taxes.

So go ahead and make those changes, just do it with your eyes open about how they might affect next year’s tax bill!