What Is a Deed to a House and Why It Matters?

Most people handle mortgage payments and property taxes with ease, but when someone asks, “what is a deed to a house,” things get foggy.

This crucial document often gets overlooked until it’s urgently needed. Understanding house deeds isn’t just legal jargon; it’s about protecting one’s biggest investment.

This blog will break down exactly what a house deed is, why it matters for property ownership, and how it differs from other real estate documents.

You will learn the essential types of deeds and when each applies.

What Is a Deed to a House and Why Is It Important?

A house deed is the legal document that transfers property ownership from one person to another. Think of it as the official proof that someone owns a specific piece of real estate.

Why it Matters:

- Legal Proof of Ownership: Without a deed, there’s no way to prove the property belongs to someone

- Required for Selling: No buyer will complete a purchase without receiving a proper deed

- Protects Against Fraud: Recorded deeds create a public record that prevents others from claiming ownership

- Needed for Refinancing: Lenders require deed verification before approving new loans

- Essential for Inheritance: Families need deeds to transfer property when loved ones pass away

What Is a House Property Deed Used For?

Property deeds serve multiple critical functions beyond simple ownership transfer. Here’s when these documents come into play:

- Transfer property ownership during sales or gifts

- Add or remove names from property titles (like after marriage or divorce)

- Establish legal boundaries and property descriptions

- Resolve ownership disputes through documented proof

- Complete estate transfers after someone dies

- Correct errors in previous property records

- Secure mortgage loans and refinancing agreements

- Create official public records for property history

Property Deed Vs Property Title: Key Differences

Many people confuse deeds and titles, but they’re not the same thing. Here’s a clear breakdown:

| Aspect | Property Deed | Property Title |

|---|---|---|

| What it is | Physical document transferring ownership | Legal concept of ownership rights |

| Tangibility | Actual paper or digital document | Abstract right, not a document |

| Purpose | Proves ownership transfer occurred | Represents the right to own and use property |

| Recording | Must be recorded with the county office | Not recorded; it’s a status, not a document |

| Transfer | Changes hands during a property sale | Transfers through the deed |

| Evidence | Shows who owned property at a specific time | Confirmed through title search and insurance |

| Legal weight | Enforceable contract between parties | Bundle of ownership rights |

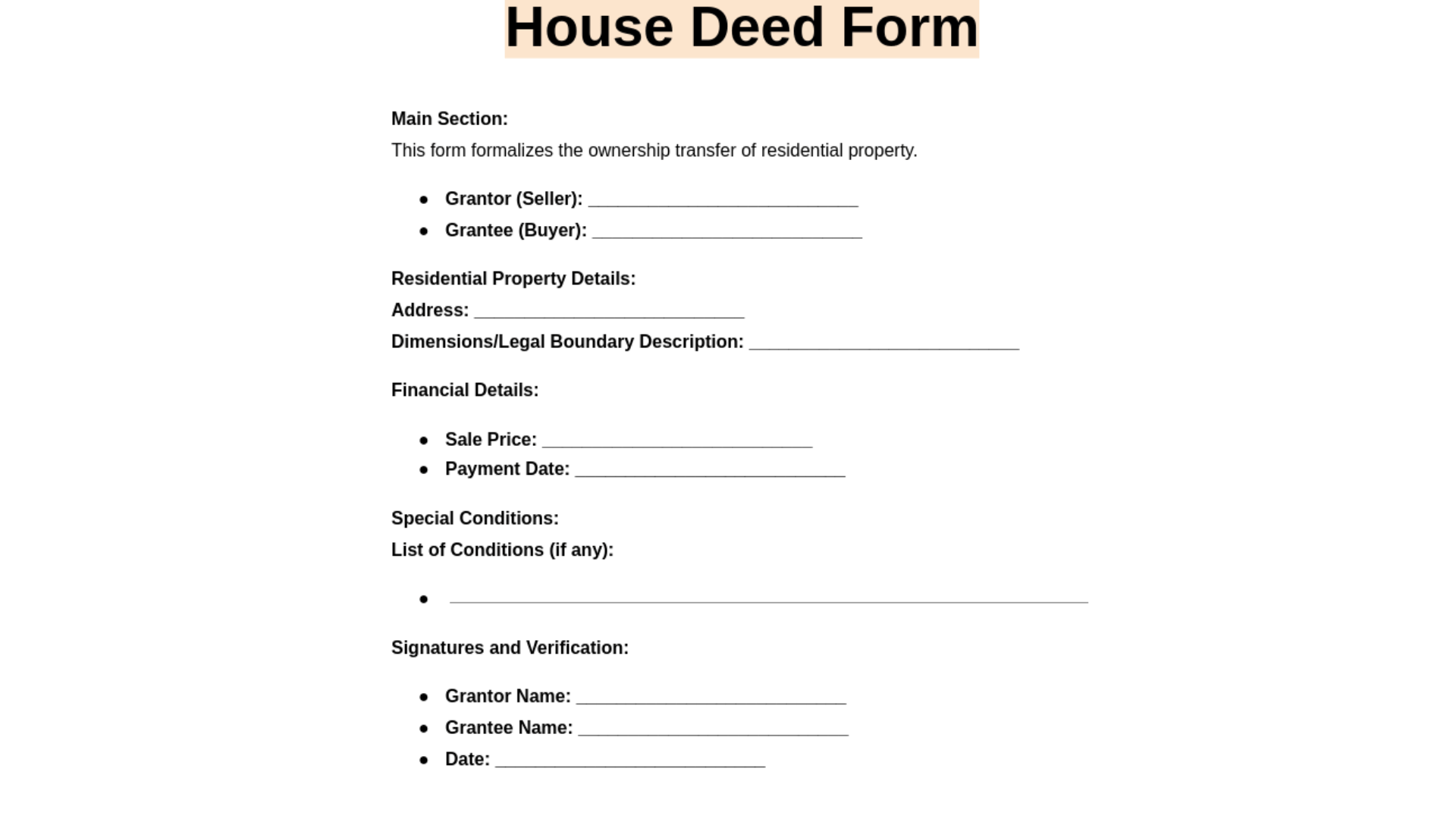

Information Included in a Property Deed

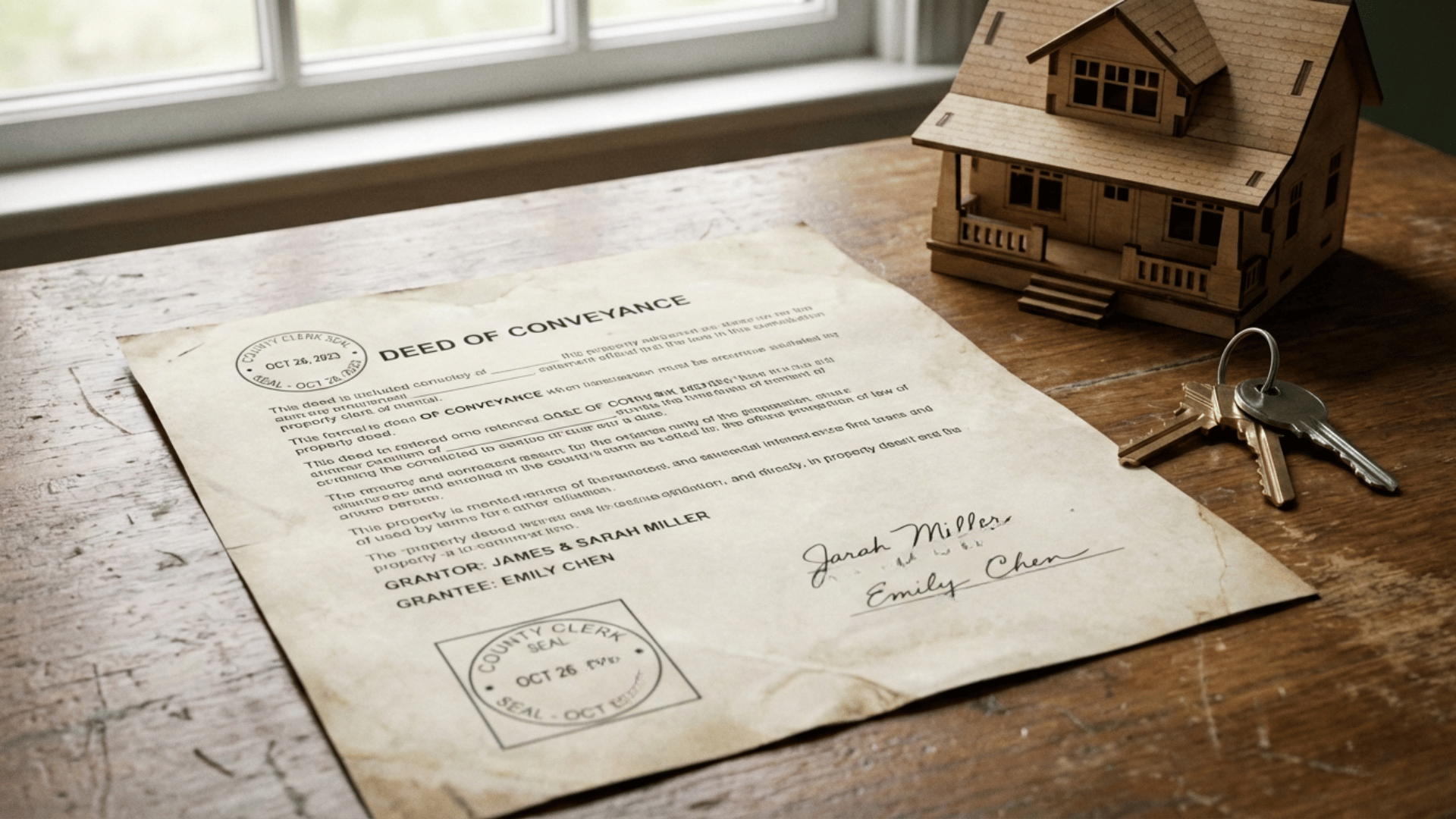

Every property deed contains specific details that make it legally binding. The document begins with the grantor’s (seller’s) name and the grantee’s (buyer’s) name, along with their addresses.

Next comes the legal description of the property, which is far more precise than a street address; it includes lot numbers, subdivision names, and boundary measurements.

The deed also states the consideration, or purchase price, though sometimes this shows as “$10 and other valuable consideration” for privacy.

Additionally, it includes any restrictions or easements that come with the property, like utility access rights. The date of transfer, notary acknowledgment, and signatures of all parties make the deed official.

Some deeds also reference prior deeds to establish a clear chain of ownership.

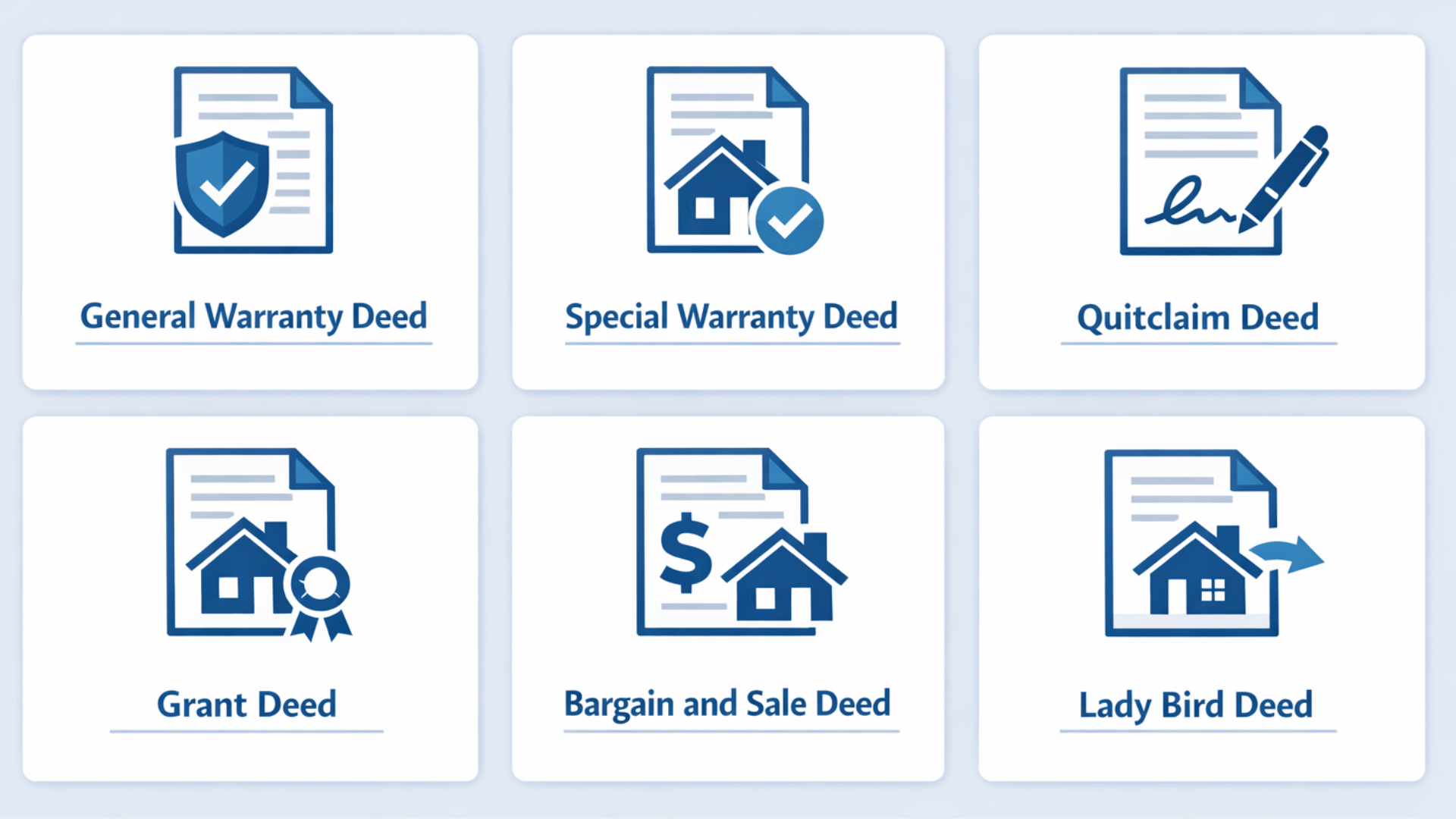

Types of Property Deeds You Should Know

Different situations call for different deed types, and each offers varying levels of protection for buyers.

1. General Warranty Deed

This is the gold standard of property deeds. The seller guarantees they own the property free and clear, with no hidden liens or claims against it.

If any title problems arise at any point in the property’s history, even decades ago, the seller remains responsible.

Buyers get maximum protection, which is why most real estate purchases use this deed type. It’s also the deed mortgage lenders prefer because it minimizes risk.

2. Special Warranty Deed

Here’s a middle-ground option. The seller only guarantees the title was clear during their ownership period. Any issues that existed before they bought the property? Not their problem.

This deed type is common in commercial real estate and foreclosure sales. It offers some protection but not as much as a general warranty deed, so buyers should invest in thorough title insurance.

3. Quitclaim Deed

This is the simplest deed with zero guarantees. The seller transfers whatever interest they have in the property, if any. There’s no promise that they actually own it or that the title is clear.

Quitclaim deeds work well for transfers between family members, adding a spouse to a title, or clearing up title questions.

But for regular home purchases? Skip this one. The risk is too high for buyers.

4. Grant Deed

Popular in some states, this deed sits between warranty and quitclaim deeds. The seller promises they haven’t sold the property to anyone else and haven’t created any undisclosed liens during their ownership.

It offers moderate protection. Grant deeds are common in California and a few other western states, where they’re the standard for most residential transactions.

5. Bargain and Sale Deed

This deed implies the seller owns the property but makes no promises about liens or other title issues. It’s frequently used in tax sales, foreclosures, and estate sales where the seller might not have complete title information.

Buyers should proceed with caution and always get title insurance with this deed type.

6. Lady Bird Deed ( Improvised Life Estate Deed)

This specialized deed lets property owners keep full control of their property while alive, including the right to sell or mortgage it, but automatically transfers it to named beneficiaries at death.

It avoids probate and protects assets from certain creditors. Only a handful of states recognize this deed type, making it a regional solution for estate planning.

How and Where to Get a Copy of Your House Deed?

Lost the original deed? No problem. Deeds are public records, so getting copies is easy.

The county recorder’s office is your first stop. This is where all deeds are filed and stored. Many counties now offer online databases for quick access.

Online Retrieval

- Visit the county recorder’s website

- Search by property address or owner’s name

- Download or print (usually $1-5 per page)

- Most sites provide instant access

In-Person or Mail

- Visit the county office during business hours

- Provide the property address and recording date

- Pay copy fee ($5-15)

- Certified copies available for legal use

- Mail requests take 3-5 business days

Other Sources

- State land records databases (some states offer centralized systems)

- Title company portals (often free for basic searches)

- Third-party property websites (may charge fees)

- Local courthouse records department

- County assessor’s office

- Real estate attorneys (for complex cases)

Online sources give instant results, while physical offices take a few days. Choose certified copies when needed for official transactions.

What to Do if You Lose Your Property Deed?

Losing a property deed isn’t as catastrophic as it might seem. The original deed’s purpose was to record ownership with the county, and that recorded copy is what truly matters.

The county keeps permanent records, so ownership remains secure even without the original document. To replace a lost deed, start by contacting the county recorder’s office where the property is located.

Request a certified copy of the recorded deed, which carries the same legal weight as the original. There’s typically a small fee, usually between $5 and $25.

For added protection, consider ordering multiple certified copies and storing them in different secure locations.

Store one copy in a fireproof safe at home, another in a safe deposit box, and give one to a trusted family member or attorney.

Common Real Estate Terms You Should Know

-

Grantor – The person or entity selling or transferring property ownership to another party.

-

Grantee – The person or entity receiving property ownership from the grantor.

-

Consideration – The payment or value exchanged for the property, typically the purchase price.

-

Legal Description – A detailed geographical description of the property using surveyor measurements, lot numbers, and boundaries rather than just a street address.

-

Recording – The process of filing the deed with the county to create a public record of the ownership transfer.

-

Chain of Title – The historical sequence of all owners and transfers of a property from the original owner to the current one.

-

Encumbrance – Any claim, lien, or restriction on the property that affects its value or use, such as mortgages or easements.

-

Easement – A legal right for someone else to use a portion of the property for a specific purpose, like utility access.

-

Title Search – An examination of public records to confirm property ownership and identify any liens or claims.

-

Title Insurance – Insurance that protects buyers and lenders against financial loss from title defects or ownership disputes.

-

Conveyance – The legal transfer of property from one owner to another.

-

Vesting – The way ownership is held, such as sole ownership, joint tenancy, or tenancy in common.

-

Acknowledgment – A notary’s certification that the person signing the deed is who they claim to be.

-

Habendum Clause – The “to have and to hold” section that defines the ownership rights being transferred.

-

Covenant – A promise or guarantee made by the grantor about the property’s title status.

It’s a Wrap

Knowing what a deed to a house is goes beyond paperwork; it’s about securing legal ownership and protecting property rights.

From warranty deeds, which offer maximum protection, to quitclaim deeds for simple transfers, each type serves a specific purpose.

People should know which deed they hold and what protections it provides. The next step is straightforward: locate the deed, verify it’s recorded with the county, and store it safely.

For anyone buying property soon, working with a real estate attorney ensures the right deed type for the situation.