Best 7 Home Improvement Paths to a Debt-Free, Comfortable Lifestyle

Building a comfortable home and achieving financial peace can go hand in hand. Many people dream of a cozy space where everything feels balanced—financially and emotionally. The truth is, improving your home can also help you take small but meaningful steps toward a life free from financial stress. Let’s look at seven positive ways you can turn your home into a comfortable, debt-free haven while boosting your daily living experience.

1. Simplify Your Living Space

A clutter-free home feels lighter, calmer, and easier to manage. By keeping only what truly adds value to your life, you create an environment that supports peace of mind. Minimalism isn’t just about having fewer things—it’s about having space that reflects your priorities and helps you focus on what matters most.

Organizing your surroundings also helps reduce unnecessary spending since you’re more aware of what you already own. A tidy, well-arranged home gives you a sense of clarity and makes it easier to maintain control over your finances.

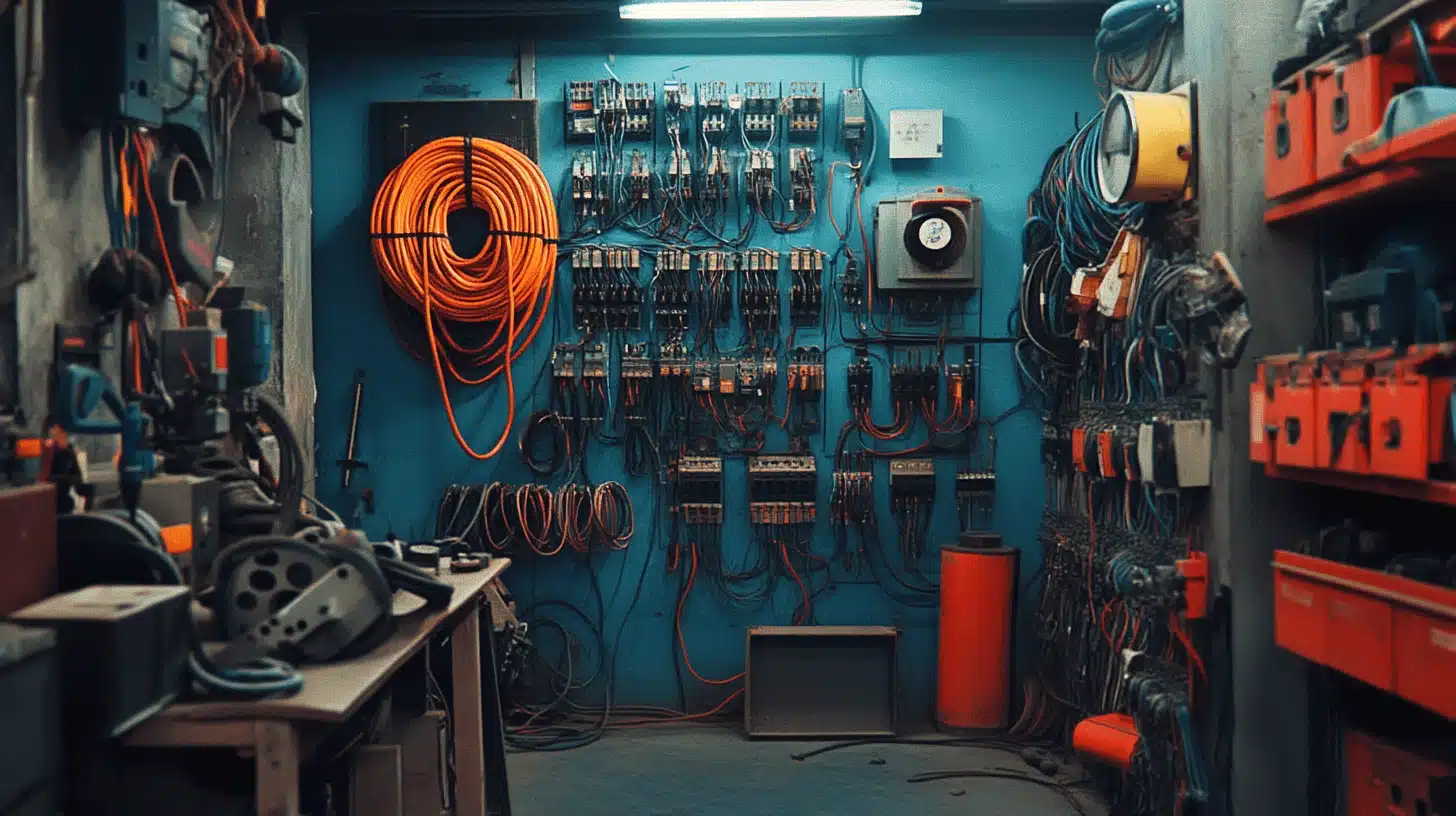

2. Focus on Energy Efficiency

Small home upgrades can bring long-term comfort and financial benefits. Energy-efficient lighting, appliances, and insulation not only make your living space more comfortable but also help you save on utility bills. Over time, these savings can contribute to your debt-free goals without you even realizing it.

Improving your home’s efficiency adds lasting value and supports a sustainable lifestyle. You can start small—perhaps by switching to LED bulbs or installing smart thermostats that help manage energy use better.

3. Smart Financial Planning for Home Goals

Your home improvements can align beautifully with smart financial planning. Creating a simple budget for upgrades allows you to enjoy the process while staying within your means. This kind of mindful spending ensures your comfort grows alongside your financial stability.

For individuals handling debt, it’s helpful to explore a consumer proposal. It provides a structured way to reduce debt through manageable payments, allowing you to maintain control of your finances and continue investing in your home’s comfort without unnecessary stress.

4. Create Multi-Purpose Spaces

Every corner of your home can serve multiple uses when planned thoughtfully. A cozy reading nook can double as a workspace, and a dining area can also become a craft zone. By creating multi-purpose spaces, you make better use of what you already have and reduce the urge to expand or spend more.

This approach adds flexibility and a sense of creativity to your living space. It brings balance between function and comfort, letting you enjoy each part of your home to its fullest.

5. Add Comfort with Thoughtful Upgrades

Simple home improvements can bring daily satisfaction and peace. Repainting walls with calming colors, updating lighting, or adding indoor plants can completely transform the atmosphere. These touches make your space feel welcoming and comfortable without requiring large expenses.

When your surroundings feel fresh and inviting, your mood improves, and that positivity extends to your financial habits too. You’re more likely to stay organized and make thoughtful spending choices when your home feels rewarding to live in.

6. Balance Home Upgrades and Financial Freedom

Comfort isn’t just about decor—it’s also about how relaxed you feel financially. Balancing home improvements with financial management can help you create lasting harmony. A calm space pairs perfectly with a calm financial outlook.

If you’ve been exploring better ways to manage multiple payments, a debt consolidation plan can be a valuable option. It brings your payments together into one manageable amount, helping you stay consistent while enjoying the freedom to continue improving your living environment responsibly.

7. Build Emotional Comfort Through a Positive Home Atmosphere

A comfortable home is not only about furniture or finances, it’s about the atmosphere you create within it. Adding personal touches, displaying meaningful photos, and maintaining open communication among family members all contribute to emotional well-being.

When your home feels peaceful, it becomes a source of motivation. This emotional comfort encourages positive habits, like saving, budgeting, and prioritizing needs over wants. Over time, this mindset leads naturally toward financial independence and a truly fulfilling lifestyle.

A Comfortable Lifestyle Starts at Home

Your home can be a reflection of balance, peace, and financial confidence. Each small improvement, from better organization to mindful upgrades, plays a role in shaping a lifestyle filled with comfort and control. Pairing these home improvement paths with smart financial steps helps you move closer to a debt-free future without giving up the comforts you enjoy.

Living comfortably doesn’t always mean spending more, it means creating harmony between your space, habits, and financial choices. With mindful planning, you can make your home a sanctuary that supports both relaxation and financial success.