Roof Insurance Inspections: Everything Explained

Your roof protects everything you own. But when storm damage hits or your shingles start failing, getting your insurance company to pay for repairs becomes a battle.

Insurance adjusters might downplay damage. Claims get denied for missing paperwork. And without the right inspection, you could lose thousands in coverage.

Most homeowners don’t know what insurers actually look for during roof inspections. They miss critical documentation steps. They accept low settlements without question.

This guide shows you exactly how roof inspections work for insurance claims.

You’ll learn when insurers require inspections, what inspectors examine, how to prepare your roof, and how to deal with adjusters.

We’ll cover inspection methods, documentation rules, and new technologies changing the industry. By the end, you’ll know how to protect your claim and get fair coverage.

Why Insurance Companies Require Roof Inspections?

Insurance companies order roof inspections at specific times to protect their investment in your home.

When you apply for a new policy, the insurer wants to see your roof’s condition before agreeing to cover it. During policy renewals, they check if your roof has gotten worse over the years.

After a storm hits your area, the insurance company inspects to confirm damage before paying claims.

If your roof is over 15-20 years old, sits in a hurricane or hail zone, or you just finished major repairs, expect an inspection request. The results directly impact your wallet.

A roof in poor shape can lead to higher premiums, coverage exclusions for roof damage, or even a denied policy. Insurers use these inspections to decide if you’re a safe bet or a costly risk.

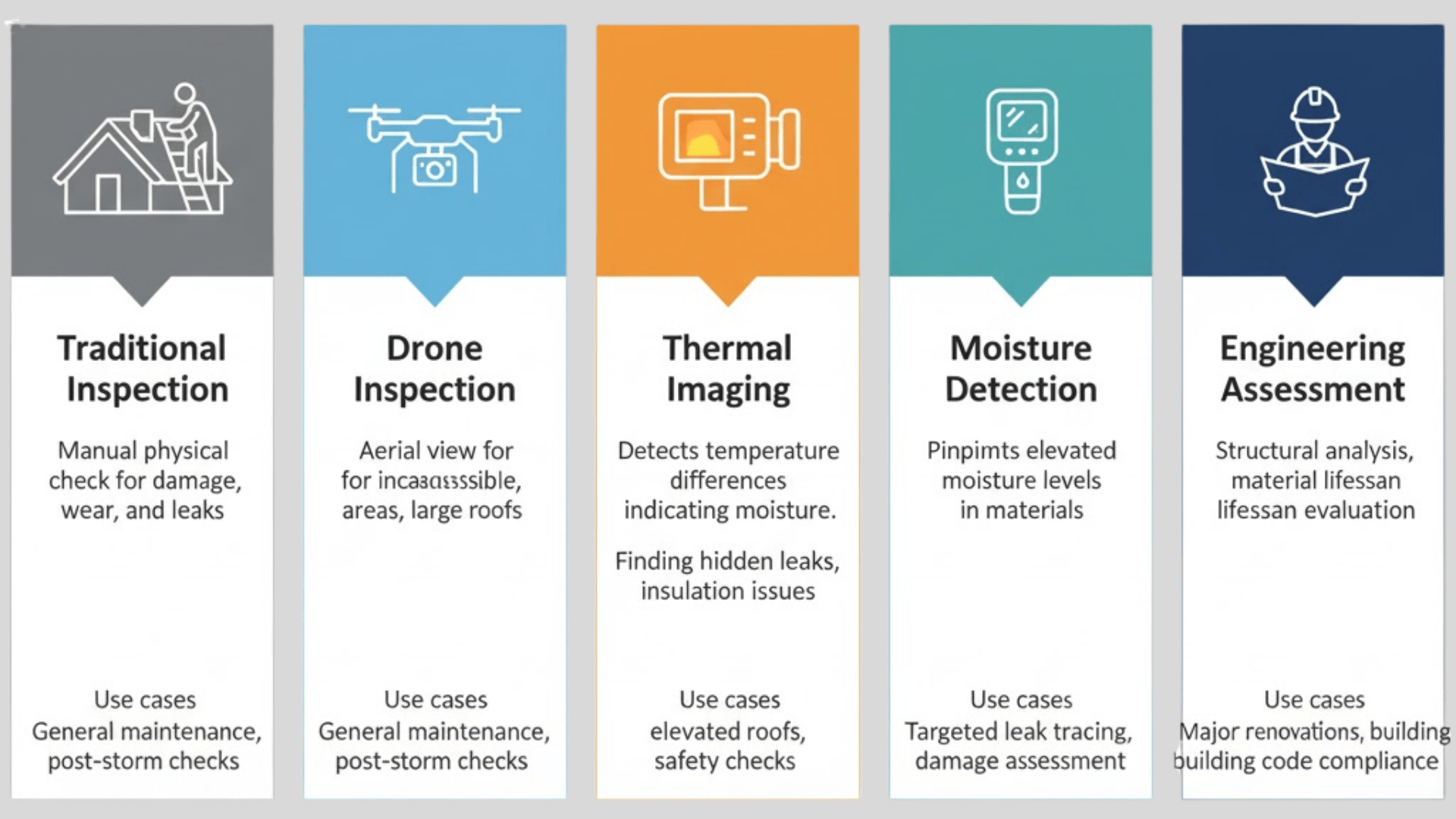

Types of Roof Inspections for Insurance

Before filing a claim or renewing your policy, it helps to understand the different types of roof inspections your insurer might require. Each method offers unique advantages depending on your roof’s condition and the purpose of the inspection.

| Type | How It’s Done | Best For | Key Advantage |

|---|---|---|---|

| Visual Inspection | The inspector walks the roof or uses a ladder to assess visible damage. | Routine checks & small claims. | Simple, affordable, hands-on. |

| Drone / Aerial | Drone captures high-res images from above. | Large or steep roofs. | Safe, fast, detailed coverage. |

| Thermal / Infrared | Detects temperature changes to find hidden leaks. | Flat roofs, storm damage. | Reveals moisture & insulation issues. |

| Moisture Testing | Sensors locate trapped water within the roof layers. | Suspected leaks or mold. | Accurate, non-destructive. |

| Engineering Assessment | Structural engineer inspects framing & load safety. | Major damage or disputes. | Highly detailed expert report. |

What Inspectors Look For?

Roof inspectors check every detail to assess your roof’s condition and risk level. Here’s what they examine:

- Roof materials: shingles, tiles, metal, membrane. They identify what your roof is made of and check if it matches insurance records.

- Shingle condition: missing, cracked, curling, or granule loss. Inspectors look for broken or worn shingles that could leak or fail soon.

- Flashing, vents, and penetrations (such as chimneys and skylights) are examined for seals around openings where water often sneaks in.

- Gutters, downspouts, drainage: Inspectors check if water flows away properly or pools on your roof.

- Structural integrity: decking, rafters, sagging: They look for dips, weak spots, or damage to the wood underneath.

- Underlayment, insulation, attic check (for leaks/mold): Inspectors enter your attic to identify water stains, mold, or inadequate insulation.

- Signs of past repairs, patches, wear and tear: They note old fixes to see if problems keep coming back.

- Weather damage indicators (hail, wind, storm debris): Inspectors search for dents, missing pieces, or other storm-related damage.

- Hidden issues: moisture intrusion, rot, and mold. They use tools to find problems you can’t see with your eyes.

- Roof age, maintenance history, warranties: Inspectors review how old your roof is and whether you’ve kept it in good shape.

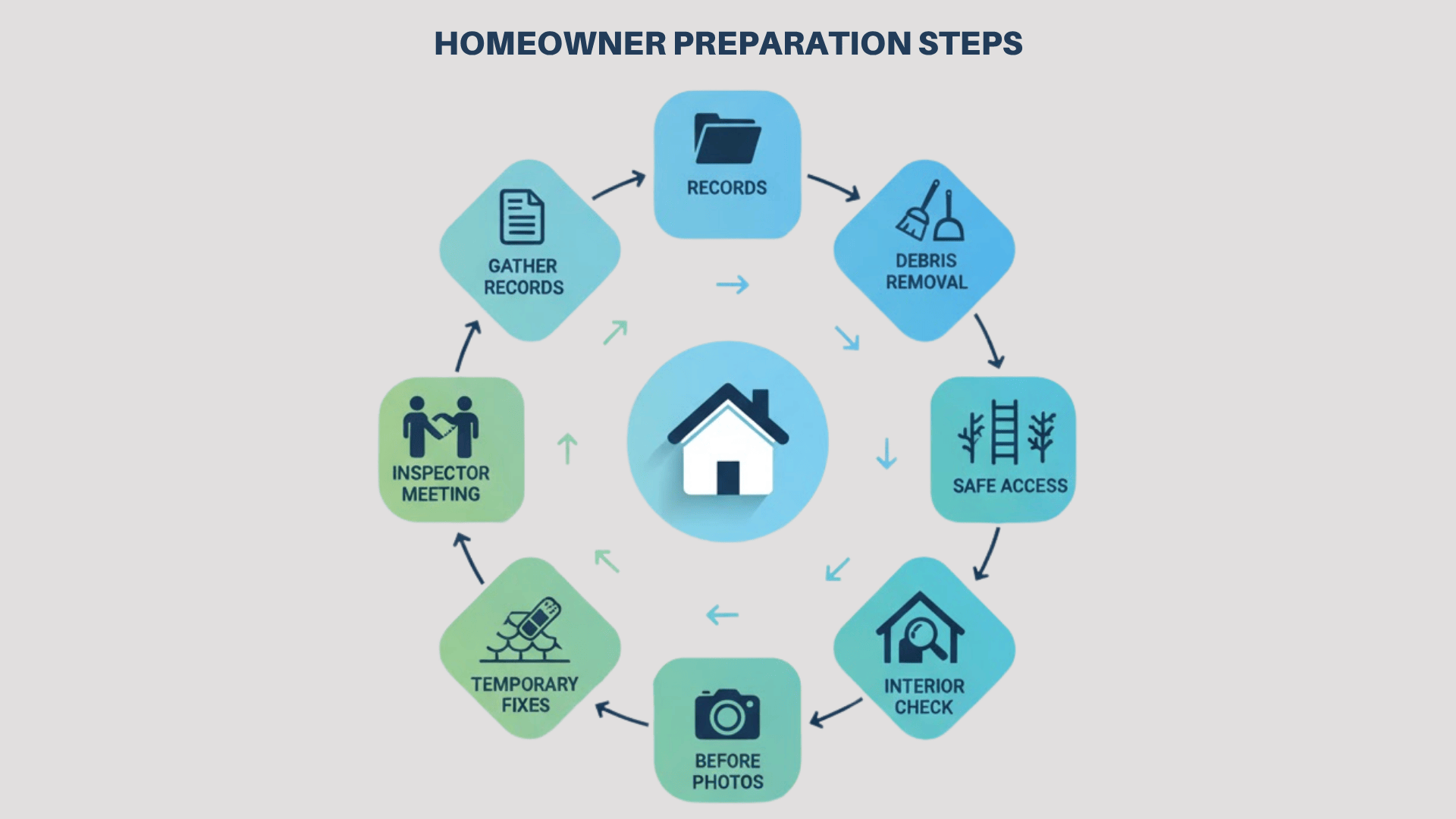

How to Prepare Your Roof & Homeowner’s Role

Getting ready for a roof inspection helps the process go smoothly. Here’s what you should do:

1. Gather roof history, receipts, and maintenance records

Collect all paperwork about your roof. Include installation dates, repair bills, and warranty documents. This proves you’ve taken care of your roof over time.

2. Clean debris, clear gutters, and remove obstructions

Remove leaves, branches, and dirt from your roof and gutters. Clear away anything blocking the inspector’s view. A clean roof makes damage easier to spot.

3. Provide safe access to the roof

Cut back tree branches hanging over your roof. Make sure the inspector can safely reach all areas. Clear the space where they’ll place their ladder.

4. Inspect attic interior (for stains, mold, leaks)

Go into your attic and look around with a flashlight. Check for water stains, mold spots, or damp insulation. Take note of anything unusual to show the inspector.

5. Take “before” photos if you suspect damage

Snap pictures of any damage you’ve noticed. Photograph problem areas from multiple angles. These images help support your insurance claim later.

6. Temporary repairs (prevent further damage)

If you have active leaks, cover them with tarps or quick patches. This stops the damage from getting worse while you wait. Just don’t hide the original problem from the inspector.

7. Be ready to accompany the inspector / point out damage

Plan to be home during the inspection. Walk around with the inspector and point out concerns. Answer their questions about your roof’s history honestly.

Documentation & Reporting Requirements

Proper documentation can make or break your insurance claim. Here’s what you need:

1. What insurance adjusters require in a report

Adjusters need complete, accurate reports that prove damage exists and show its extent.

- Detailed descriptions, measurements: Write exactly what’s damaged and how big the affected area is in square feet.

- Location markers, roof diagram: Mark problem spots on a simple roof sketch so adjusters know where to look.

- High-resolution photos from multiple angles: Take clear, close-up pictures and wide shots from different sides of your roof.

- Time stamps, metadata: Keep the date and time stamps on your photos to prove when damage occurred.

2. How to organize your report (sections, priorities)

Group information by topic, with the worst damage listed first and minor issues at the end.

3. Adding repair estimates/quotations

Include written quotes from licensed contractors that break down labor and material costs for each repair.

4. Including weather data, local storm records

Attach weather reports or news articles showing storms hit your area on specific dates.

5. Maintaining records for future reference

Store all inspection reports, photos, and receipts in a safe place for future claims or policy renewals.

How Much Does a Roof Inspection Cost

Understanding roof inspection pricing helps you budget wisely and avoid surprises during the insurance process. Here’s what goes into the cost and why it’s worth every dollar.

| Type of Inspection | Typical Cost | Time Needed | Key Benefit / ROI |

|---|---|---|---|

| Basic visual inspection | $125 – $350 | 30 min – 2 hrs | Documents the roof condition; supports insurance claims |

| Drone / aerial inspection | +$100 – $300 | +30–45 min | Safer access; high-quality photos for claims |

| Thermal/infrared scan | +$150 – $400 | +30–60 min | Detects hidden leaks or moisture damage |

| Roof certification report | +$75 – $200 | 1–3 days turnaround | Satisfies insurer or lender requirements |

| Emergency / post-storm inspection | 10–30% higher | Same-day / next-day | Faster claim filing after storm events |

Dealing with Insurance Adjusters & the Claims Process

Working with adjusters requires strategy and patience. Here’s how to handle the process:

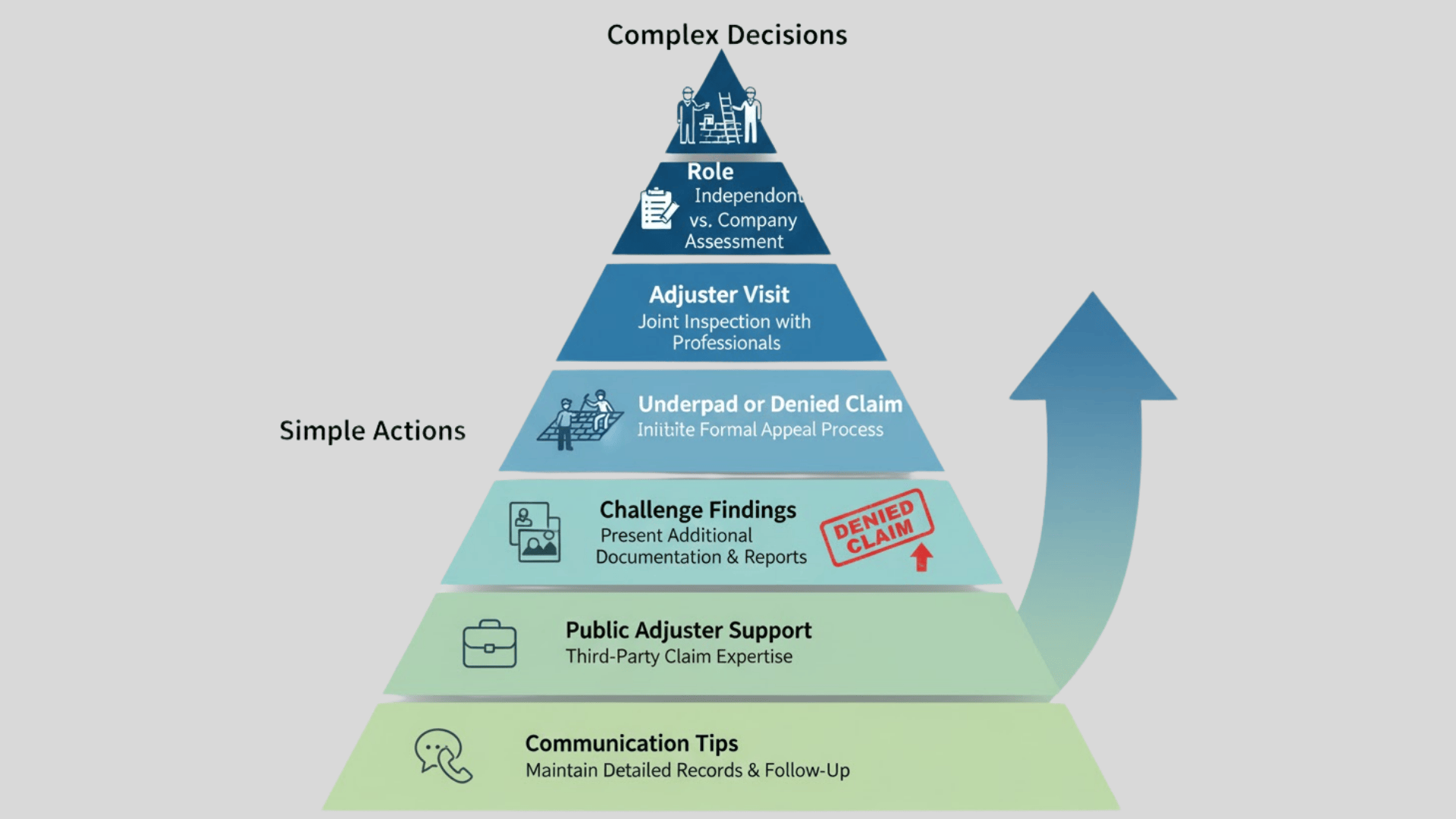

1. Role of the insurance adjuster vs your roof inspector

Your inspector works for you and documents all damage in detail. The insurance adjuster works for the insurer and decides what they’ll pay. They often have different goals.

2. Being present during an adjuster visit, tips & strategy

Always be home when the adjuster comes. Walk the roof with them if possible. Point out every damaged area you’ve found. Don’t let them rush through the inspection.

3. How to present additional evidence or challenge findings

Bring your own photos, contractor estimates, and inspection reports. Show proof of damage they might have missed. Ask questions if their assessment seems low or incomplete.

4. What to do if the claim is underpaid or denied

Request a written explanation for the denial or low payout. Get a second opinion from an independent inspector. File an appeal with your insurance company within its deadline.

5. Working with public or independent adjusters

Hire a public adjuster if your claim is large or disputed. They work for you, not the insurer, and take a percentage of your settlement. Independent adjusters can provide unbiased third-party reports.

6. Tips for smooth communication and negotiations

Keep all conversations polite but firm. Document every phone call and email exchange. Never accept the first offer without reviewing it carefully. Ask for time to consult with contractors before signing anything.

Looking Ahead

Roof inspections for insurance aren’t just paperwork. They determine whether you get full coverage or face denials and higher premiums.

Understanding when insurers require inspections, what they look for, and how to document damage properly puts you in control. Prepare your roof before the inspector arrives.

Gather all maintenance records and take detailed photos. Be present during adjuster visits and don’t accept lowball offers without question.

The insurance company has experts working for it. You need to be just as prepared.

Whether you’re filing a storm damage claim or applying for new coverage, proper inspections and solid documentation protect your investment.

Ready to get your roof inspected? Schedule a professional inspection today!