Where HomeGoods Gets Stock: Inside the Supply Chain

I’ve always been curious about why shopping at HomeGoods feels like a treasure hunt. On one visit, you see shelves filled with high-end furniture, and the next, they’re stocked with artisan décor from halfway across the world.

If you’ve ever walked out wondering where it all comes from, you’re not alone. The secret lies in how the HomeGoods supply chain works.

Part of the mystery is tied to its buying model and why HomeGoods doesn’t sell online, which keeps the focus on in-store discovery.

In this post, I’ll show you how they source products, why prices stay low, and what makes the shopping experience so unpredictable yet exciting.

By the end, you’ll know exactly how HomeGoods gets stock and why it matters for you.

What Makes HomeGoods Different

HomeGoods stands apart because it doesn’t follow the traditional retail playbook. Instead of ordering set collections months in advance, it uses an off-price retail model.

Buyers step in whenever opportunities arise, whether it’s overstock, cancelled retailer orders, or manufacturer closeouts.

This flexible strategy keeps costs low and shelves stocked with bargains. This off-price approach sets HomeGoods apart from most retailers, though there are similar stores to HomeGoods that follow the same model.

The trade-off is unpredictability. No two stores look the same, and new shipments change the floor constantly. That sense of surprise is what turns every trip into a treasure hunt.

The Role of TJX in HomeGoods’ Supply Chain

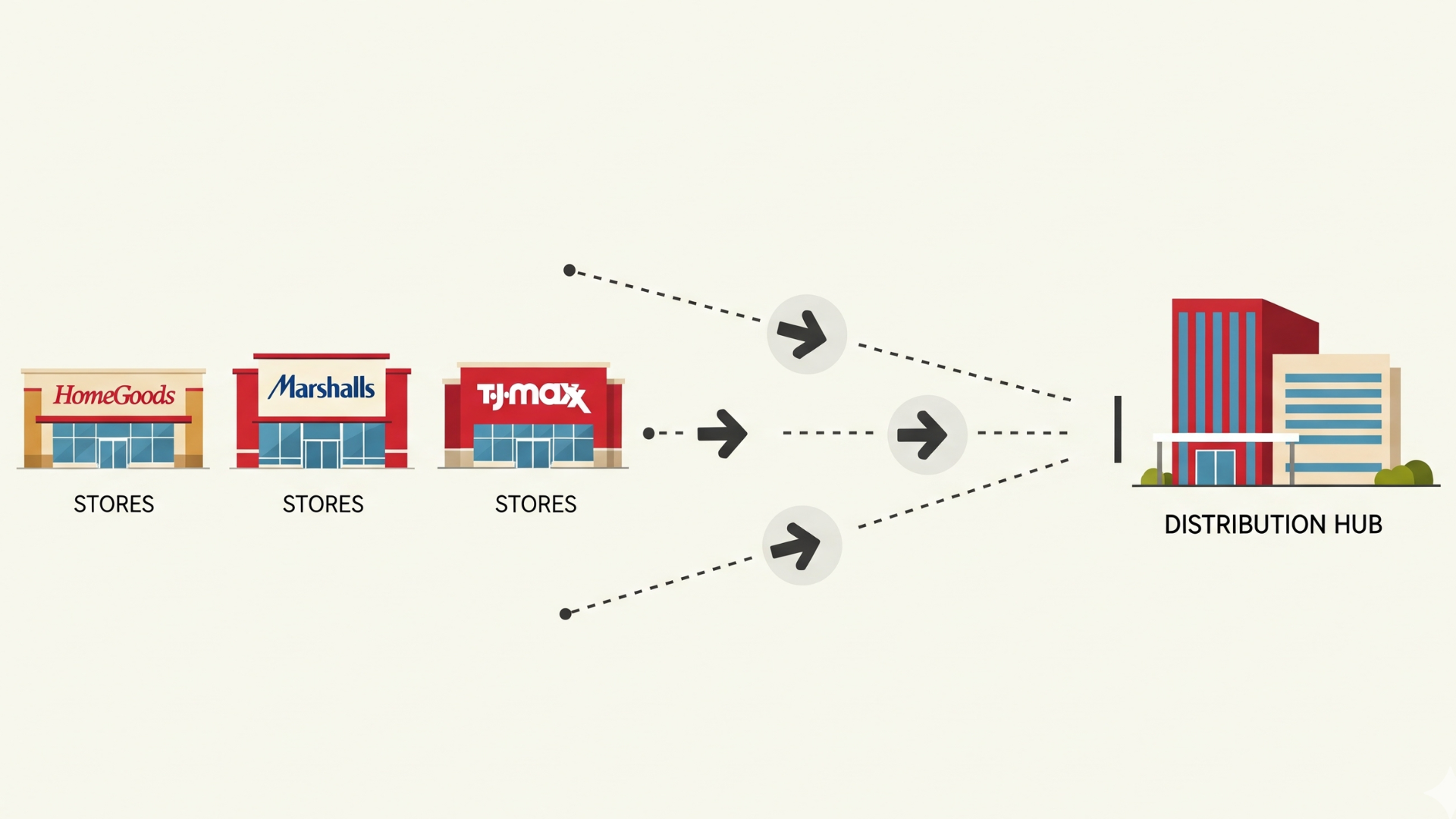

HomeGoods operates under The TJX Companies, the parent group behind T.J. Maxx, Marshalls, and Sierra.

With more than 1,300 buyers sourcing globally, TJX secures merchandise from thousands of vendors and markets.

This shared buying power, along with centralized distribution centers and long-term vendor relationships, gives HomeGoods a competitive edge.

The scale allows them to negotiate deeper discounts, streamline freight contracts, and move inventory quickly. As a result, HomeGoods can consistently stock shelves with fresh finds at prices rivals struggle to match.

Where HomeGoods Gets Its Stock

HomeGoods sources inventory through overproduction, canceled orders, seasonal surpluses, direct global vendors, and private label goods, ensuring a constant variety.

1. Manufacturer Overproduction

When factories produce more goods than retailers can handle, HomeGoods purchases the extras at discounted rates. This includes furniture, rugs, bedding, and décor.

By clearing surplus quickly, manufacturers free up space, while shoppers gain access to quality merchandise priced far below its original retail value.

2. Cancelled Orders from Retailers

Department stores often cancel orders due to shifting trends, seasonal changes, or budget adjustments. Instead of losing money, vendors sell those goods to HomeGoods at reduced prices.

This ensures brands recover costs while shoppers enjoy access to recognizable products at significantly lower prices than traditional retail stores.

3. Overstock and Seasonal Surplus

At season’s end, many retailers hold excess items like holiday décor or furniture. Instead of storing unsold stock, they sell it to HomeGoods.

Shoppers then encounter timely products, often just months old, at deeply discounted prices. This cycle keeps inventory fresh, affordable, and constantly changing throughout the year.

4. Direct Vendor and Global Sourcing

HomeGoods also partners directly with international vendors and artisans. Buyers travel worldwide, attending trade shows and markets in Europe, Asia, and South America, to secure exclusive items.

These include handcrafted furniture, ceramics, and décor not found at department stores, ensuring HomeGoods maintains its distinctive treasure-hunt shopping appeal.

5. Private Label Goods

To guarantee dependable availability in essentials like bedding, kitchenware, and storage, HomeGoods develops private-label lines exclusive to TJX brands. These products ensure shelves remain stocked with basics even when opportunistic buys fall short.

Private labels balance unpredictability, giving shoppers consistent staples alongside unique and surprising finds.

Behind the Scenes: How the Buying Process Works

HomeGoods relies on speed and flexibility rather than long-term planning. Unlike traditional retailers that lock in product lines months ahead, its buyers operate on shorter timelines.

They scout trade shows, visit vendors worldwide, and negotiate quickly when opportunities arise, whether that means overstock, cancelled orders, or unique artisan goods.

Buyers also test small batches of trending items to gauge shopper interest. This responsive approach explains why HomeGoods often carries popular décor styles before larger, slower-moving retailers can stock them.

Distribution and Logistics

Once products are purchased, they move through regional distribution centers. These facilities sort shipments and send each store a unique mix, ensuring no two locations look the same.

However, the process isn’t without challenges:

- Labor-intensive handling often causes bottlenecks.

- Backroom overloads mean some stores keep excess stock on the sales floor.

- Human error in sorting can slow the flow of goods.

This “organized chaos” is part of why HomeGoods inventory feels random.

Shopper Perspective: What This Means for You

Shopping at HomeGoods is unlike visiting a traditional retailer because the inventory is constantly changing.

The off-price model means products arrive in limited quantities, often without restocks, so if you see something you love, it may be gone tomorrow. This unpredictability creates excitement, making every trip feel like a treasure hunt.

At the same time, opportunistic buying keeps prices low, allowing you to find brand-name or high-quality décor at a fraction of the usual cost.

Sustainability and Waste Reduction

HomeGoods’ supply chain naturally supports sustainability by reducing waste across the retail industry.

Instead of allowing surplus products to be discarded, the company buys and resells them, giving everything from seasonal décor to furniture a second life. This resale-driven approach not only diverts usable goods from landfills but also keeps quality items affordable for shoppers.

Moving forward, HomeGoods can strengthen its sustainability role by investing in eco-friendly sourcing, recycling partnerships, and greener practices throughout its global vendor network.

How HomeGoods Compares to Competitors

HomeGoods’ opportunistic model contrasts sharply with At Home, Target, and sister brands, offering unique value and shopper experiences.

| Retailer | Model Type | Strengths | Weaknesses |

|---|---|---|---|

| HomeGoods | Off-price opportunistic | Low prices, constant variety, treasure-hunt feel | Unpredictable inventory, limited restocks |

| At Home | Planned seasonal buying | Consistency, broad seasonal décor | Vulnerable to tariffs, less flexible, higher risk |

| Target | Traditional bulk retail | Reliable stock, wide categories, strong online presence | Higher prices, less unique selection |

| T.J. Maxx/Marshalls | Off-price (clothing focus) | Affordable apparel, brand names | Less home décor variety than HomeGoods |

Common Supply Chain Challenges

HomeGoods’ opportunistic model faces real-world obstacles, from shortages and tariffs to demand shifts and logistical inefficiencies.

- Material Shortages: Global supply shortages reduce the flow of overstock, limiting what HomeGoods can acquire.

- Tariffs and Trade Policy: Because much of the inventory comes from overseas, tariffs can raise costs and affect product mix.

- Shifting Consumer Demand: Trends in home décor move fast. HomeGoods relies on its buyers’ instincts to stay relevant.

- Inventory Visibility: Tracking goods across thousands of global vendors is difficult, which can lead to inefficiencies or stockouts.

- Distribution Center Bottlenecks: Labor-heavy sorting and handling can slow down replenishment, especially during peak shopping seasons.

The Future of HomeGoods’ Supply Chain

Looking forward, HomeGoods may embrace technology and new strategies to strengthen its supply chain:

- AI and digital tracking could improve inventory visibility.

- Ethical sourcing may become more important as shoppers demand transparency.

- Possible e-commerce return could expand reach without losing the in-store thrill.

Competitive positioning will continue to matter as discount retailers fight for the same surplus stock.

Conclusion

After looking deeper, it’s clear that HomeGoods’ supply chain is what makes the store so unique.

By relying on overstock, cancelled orders, and global sourcing, they turn unpredictable buying into an experience you can enjoy every time you shop.

For you, this means lower prices, a constantly changing selection, and a sense of discovery. The key takeaway? If you see something you like, grab it, because it may not be there tomorrow.

Keep finding my other blogs for more insights into shopping trends and smart ways to decorate your home.