Home Interior Remodeling on a Tight Timeline with VA Loans in Texas

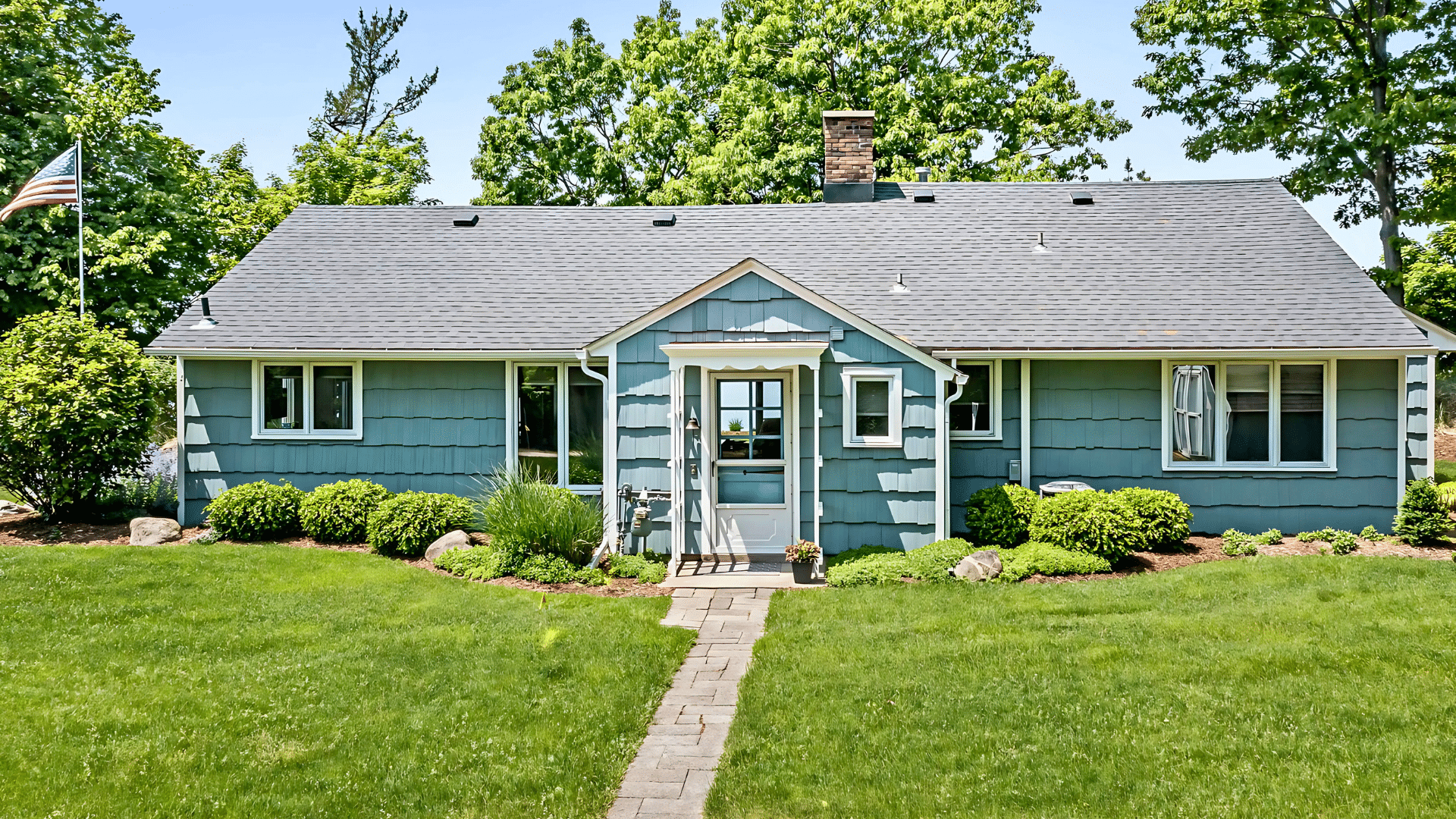

Embarking on a home interior remodeling project can be both exciting and daunting, especially when working under a tight timeline. For veterans and active military members in Texas, utilizing a VA loan for such projects can be a game-changer.

This comprehensive guide explores the ins and outs of leveraging VA loans for home remodeling, ensuring your project stays on track and within budget.

Understanding VA Loans

VA loans are mortgage loans issued by private lenders but guaranteed by the U.S. Department of Veterans Affairs (VA). These loans offer numerous benefits, including no down payment, competitive interest rates, and limited closing costs.

They are specifically designed to help veterans, service members, and eligible surviving spouses become homeowners.

Key Features of VA Loans:

- No Down Payment: Unlike conventional loans, VA loans typically do not require a down payment, making home ownership more accessible.

- Competitive Interest Rates: VA loans often have lower interest rates compared to conventional loans.

- No Private Mortgage Insurance (PMI): Borrowers are not required to pay PMI, reducing monthly mortgage payments.

- Flexible Credit Requirements: VA loans have more lenient credit requirements, making it easier for individuals with lower credit scores to qualify.

Utilizing VA Loans for Home Remodeling

While VA loans are primarily intended for purchasing homes, there are specific programs that allow for home improvement and remodeling projects:

- VA Cash-Out Refinance Loan:

This loan allows homeowners to refinance their existing mortgage and take out cash based on the home’s equity. The funds can then be used for remodeling or other purposes. - VA Renovation Loan:

This loan combines the benefits of a VA loan with a renovation loan, allowing borrowers to finance the purchase and renovation of a home in a single mortgage. It’s a great option for those buying a fixer-upper or wanting to make significant improvements to their current home.

Planning Your Remodeling Project

Effective planning is crucial for a successful remodeling project, especially when working with a tight timeline. Here’s a step-by-step guide to help you stay organized and on schedule:

1. Define Your Goals

Before diving into your remodeling project, clearly define what you want to achieve. Consider the following:

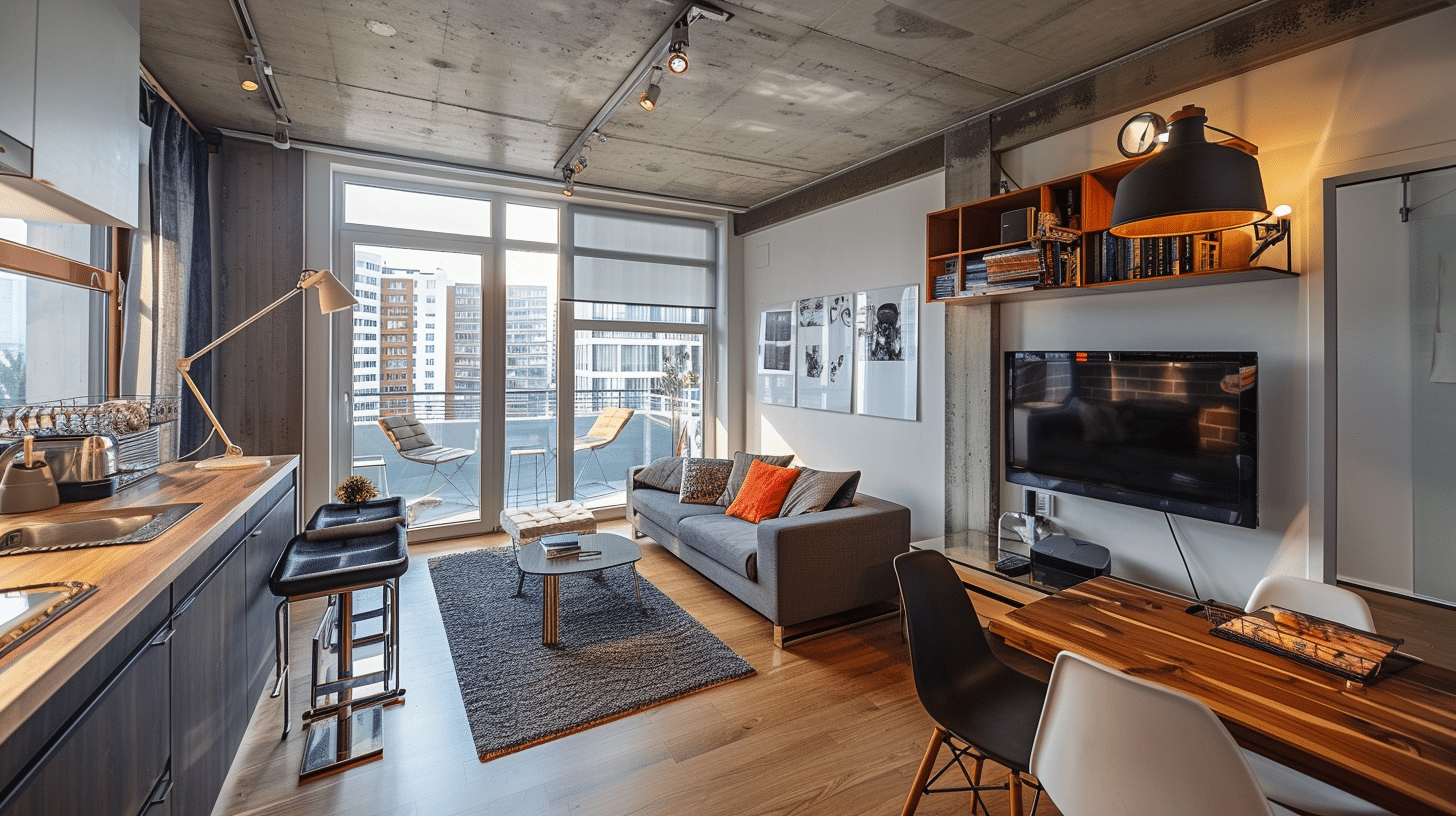

- Scope of Work: Identify the specific areas of your home that need remodeling. Are you focusing on the kitchen, bathroom, living room, or the entire house?

- Priorities: Determine which improvements are essential and which ones can be considered if time and budget permit.

- Budget: Establish a realistic budget for your project, factoring in labor, materials, and any unexpected costs.

2. Research and Hire Professionals

Finding the right professionals is crucial for staying on track. Look for contractors, architects, and designers with experience in VA loan-funded projects and a track record of completing work on time.

3. Create a Detailed Timeline

Work with your contractor to develop a detailed timeline that outlines each phase of the project. This will help you keep track of progress and ensure that each task is completed on schedule.

4. Obtain Necessary Permits

Ensure all required permits are obtained before starting the project. This will prevent delays and legal issues down the line.

Managing Your Remodeling Project

Once your project is underway, effective management is key to staying on schedule:

- Regular Communication: Maintain regular communication with your contractor and team. Regular updates and check-ins can help identify potential issues early and keep the project on track.

- Monitor Progress: Stay involved and monitor the progress of your project. Make sure that the work being done aligns with the timeline and quality standards you’ve set.

- Be Flexible: While it’s essential to stay on schedule, unexpected issues may arise. Be prepared to make adjustments and be flexible with your plans.

Tips for a Smooth Remodeling Experience

- Prioritize High-Impact Improvements: Focus on improvements that will have the most significant impact on your home’s value and functionality. Kitchens and bathrooms typically offer the highest return on investment.

- Stay Organized: Keep all project-related documents, contracts, and receipts organized. This will make it easier to track expenses and resolve any disputes.

- Plan for Contingencies: Set aside a contingency fund for unexpected expenses. This will help you avoid financial stress if issues arise during the project.

- Consider Temporary Living Arrangements: If your remodeling project is extensive, consider finding temporary housing. This will reduce stress and allow the work to proceed without disruption.

Financing Your Remodeling Project with a VA Loan

Understanding the financial aspects of using a VA loan for remodeling is crucial. Here’s what you need to know:

VA Cash-Out Refinance Loan

- Eligibility: Homeowners must have sufficient equity in their home and meet the VA’s eligibility requirements.

- Process: The process involves refinancing your existing mortgage and taking out cash based on your home’s equity. This cash can then be used for remodeling.

- Benefits: This option allows you to tap into your home’s equity without taking out a second mortgage or home equity loan.

VA Renovation Loan

- Eligibility: This loan is available for both homebuyers and current homeowners. The property must meet VA minimum property requirements after renovations.

- Process: The loan combines the purchase price of the home and the cost of renovations into a single mortgage.

- Benefits: It simplifies the financing process by allowing you to borrow for both the home purchase and renovations simultaneously.

Steps to Apply for a VA Loan

- Obtain a Certificate of Eligibility (COE): Apply for a COE through the VA, which verifies your eligibility for the loan.

- Choose a VA-Approved Lender: Work with a lender experienced in VA loans to guide you through the process.

- Appraisal and Underwriting: The lender will order an appraisal to determine the home’s value. The loan will then go through underwriting for final approval.

- Closing: Once approved, you’ll proceed to closing, where you’ll sign the final documents and receive the funds for your project.

Conclusion

Remodeling your home on a tight timeline can be challenging, but with careful planning and the right financing, it’s entirely achievable.

VA Loans in Texas offer a flexible and affordable option for veterans and service members in Texas looking to enhance their homes.

By understanding the process and following these tips, you can ensure your remodeling project is a success, adding value and comfort to your home.