5 Home Insurance Myths That Can Empty Your Pockets: A Guide for First-Time Homeowners

Perhaps you have recently bought a property and become a homeowner for the first time. Now, you are contemplating getting a home insurance policy. Are you skeptical about it?

The high yearly cost of home insurance may be making you rethink this. Forbes reports that the average home insurance costs USD 1,678 per year. With this premium, you will get dwelling insurance coverage of USD 350,000. That is not all—you will also need add-on policies.

However, many new homeowners think that only one type of insurance can protect their assets and property completely. You might believe that simple homeowners insurance can cover personal property damage and safeguard the house from natural disasters.

Did you know this is a myth? Misconceptions about home insurance can lead to a costly gap in coverage. In this blog post, we will discuss a few myths that homeowners need to know.

Myth 1. Old Homes Are Cheaper to Insure

First-time homeowners often think that older buildings are cheaper to insure. According to Bankrate, this is a home insurance myth because older homes are often more expensive to insure than newer ones. This misconception stems from the fact that ‘older homes have low value.’

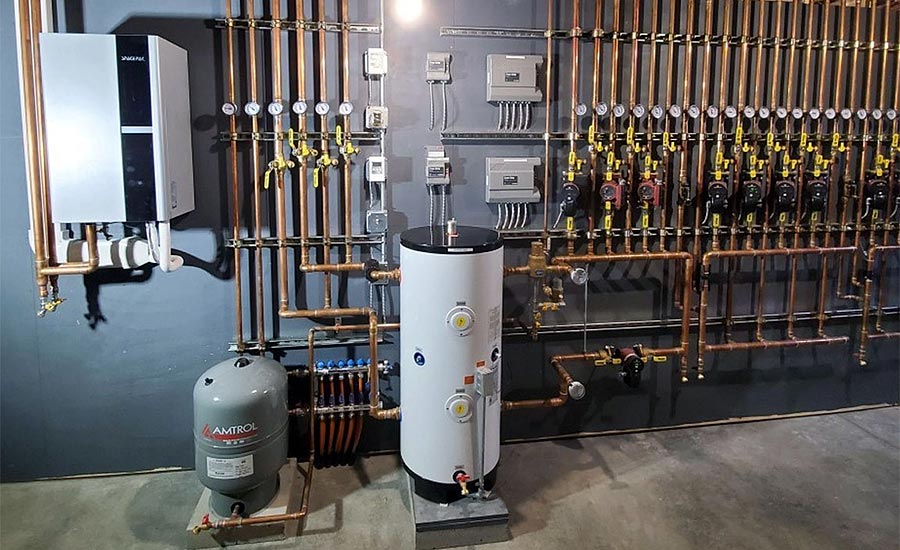

The thing is, older homes can lead to higher premium costs. If you choose a cheaper insurance plan for such properties, there is a possibility you will end up emptying your pockets. For example, you might have to fix plumbing, electrical systems, roofing and other structural damages out of pocket.

These can be costly to repair, increasing the financial risk factor for new homeowners. Sometimes, the materials used in older homes need a revamp because they do not match the current building codes. Without the right insurance coverage, this can lead to expensive refurbishments.

Myth 2. Home Insurance Covers Natural Disasters and Termite Infestations

Insurance for your home does not give you all-rounded financial protection. However, some first-time homeowners believe that it does.

They think damages from natural disasters (earthquakes and floods) will be covered by the home insurance policy they have. Similarly, there is a misconception that says that standard policies can sometimes cover termite infestations. Not addressing this can lead you to spend thousands of dollars on property damage.

According to the Insurance Information Institute, earthquakes, floods, maintenance damage and sewer backup issues are not covered by basic insurance. Instead, you will need to purchase additional coverage for specific natural disasters. On average, this can cost an extra USD 2,230 each year for a USD 300,000 coverage.

As for termite infestations, it is recommended that homeowners perform regular inspections. Based on this, you can use preventive measures to mitigate the risk and reduce damage costs.

Myth 3. Your Home Insurance Will Safeguard Personal Belongings

This misconception arises from the technical jargon that comes with an insurance policy. According to Hippo, such policies are usually filled with unfamiliar language that can be overwhelming to decode. As a result, you might misinterpret the terms, leading to financial loss.

New homeowners often think that home insurance covers the property and the personal assets in the building. However, the policies clearly state that personal property and liability are not covered. This misconception can stem from an inability to understand common homeowners insurance terms.

For example, you might not know that a ‘peril’ is a specific risk of loss covered by the policy. Similarly, many first-time insurance buyers do not have any clue about the fact that the insurance declaration page is a summary of the policy. Perhaps you don’t know what the insurance limits, exclusions or scores mean.

That is why you need to go through a glossary of terms and their definitions before buying a policy. You can also get your doubts sorted out by asking the insurance provider. Reading the policies carefully after knowing about the basic terms can help you understand the deductibles, endorsements, exclusions, premiums and more.

Getting an idea of the levels of coverage can help you determine the actual cash value and replacement value. Based on that, you can choose an umbrella policy or liability insurance for additional protection. These can safeguard the physical assets in your property.

Myth 4. Good Savings Means You Can Avoid Getting Home Insurance

According to the Consumer Federation of America, 7.4% of all properties are uninsured. That means America has USD 1.6 trillion in property value that remains unprotected. This is usually the case because of the high cost of insurance.

Similarly, some new homeowners think having significant savings means they do not need insurance. Did you know that rebuilding or renovating a house can cost USD 284,764? On average, the actual costs depend on the roofing structure, type of construction, square footage, quality of building materials and age of the property.

Even if you have high savings, this can be a significant cost that you will not be able to afford. In fact, these can be higher than the yearly home insurance policy premiums. Hence, without insurance, you cannot protect liability coverage and the additional expenses. That is why you must consider home insurance as a financial safety net.

Myth 5. You Cannot Get Homeowners Insurance if You Have a Pool, Treehouse Or Trampoline

Did you know that ‘attractive’ nuisances can increase liability risk? Yes, pools, treehouses and trampolines can limit your home’s insurance options. As a result, it will increase your premium costs. Insurers can see these elements and consider your home a higher risk.

With fun features, there is a high risk of injury. For example, pools can lead to slip-and-fall accidents and have the risk of drowning. Similarly, treehouse injuries include fractures, cuts, bruises etc. When it comes to trampolines, people can suffer from sprained ankles or broken bones.

That is why you might think that having these features can automatically disqualify you from insurance coverage. However, installing safety features can help. For instance, you can get locked gates, automatic lights or some kind of an alarm to reduce risks. Remember to discuss the coverage options and insurance rates with your agent.

Debunking common myths about homeowners insurance misconceptions can help first-time homeowners protect their finances and investments. For example, you can get add-on coverage for natural disasters and termite infestations.

Similarly, you will avoid the misconception that older homes are cheaper to insure. This will help you prevent unexpected expenses. You also get to ensure adequate protection for your personal belongings. Moreover, you will find a way to insure your pool, treehouse and trampoline.

Are you ready to make an informed decision about homeowners insurance policies?