What Is Shared Ownership and How It Really Works?

Getting on the property ladder feels impossible for many first-time buyers, especially with rising house prices outpacing wages.

Shared Ownership offers a practical alternative, but understanding how it actually works can be confusing.

This blog will break down exactly what Shared Ownership is, explain the step-by-step process of buying through this scheme, and clarify who qualifies.

You will also learn about the real costs involved, including rent, mortgages, and service charges, plus the key pros and cons to help them decide if this route to homeownership makes sense for their situation.

What Is Shared Ownership and How Does It Work?

It allows buyers to purchase a portion of a property (typically between 25% and 50%) while a nonprofit organization, housing authority, or community land trust retains the remaining equity.

Buyers need a smaller down payment since they’re only buying part of the property initially, making homeownership more accessible.

The buyer gets a mortgage for their share and may pay a nominal monthly fee to the organization holding the remaining equity.

Over time, buyers can purchase additional equity shares, eventually owning the property outright if they choose.

These programs exist through local housing authorities, community land trusts like Habitat for Humanity, and limited equity cooperatives.

This model bridges the gap between renting and full ownership, giving people a realistic path to homeownership sooner than traditional buying would allow.

Who Can Apply for Shared Ownership?

Not everyone qualifies for Shared Ownership programs, and applicants must meet specific criteria set by the sponsoring organization.

- Household income must fall within program limits, typically 80-120% of the area median income (varies by city and program)

- Applicants cannot afford to buy a suitable home on the open market

- Must be a first-time buyer or meet specific eligibility requirements for the program

- Priority often goes to local residents, essential workers, veterans, or those with demonstrated housing needs

- Applicants need proof that they can afford mortgage payments, any monthly fees, and property maintenance

- Good credit history improves chances of mortgage approval (minimum scores vary by lender)

- Some programs have age restrictions or require completion of homebuyer education courses

- Must plan to use the property as a primary residence, not an investment or rental property

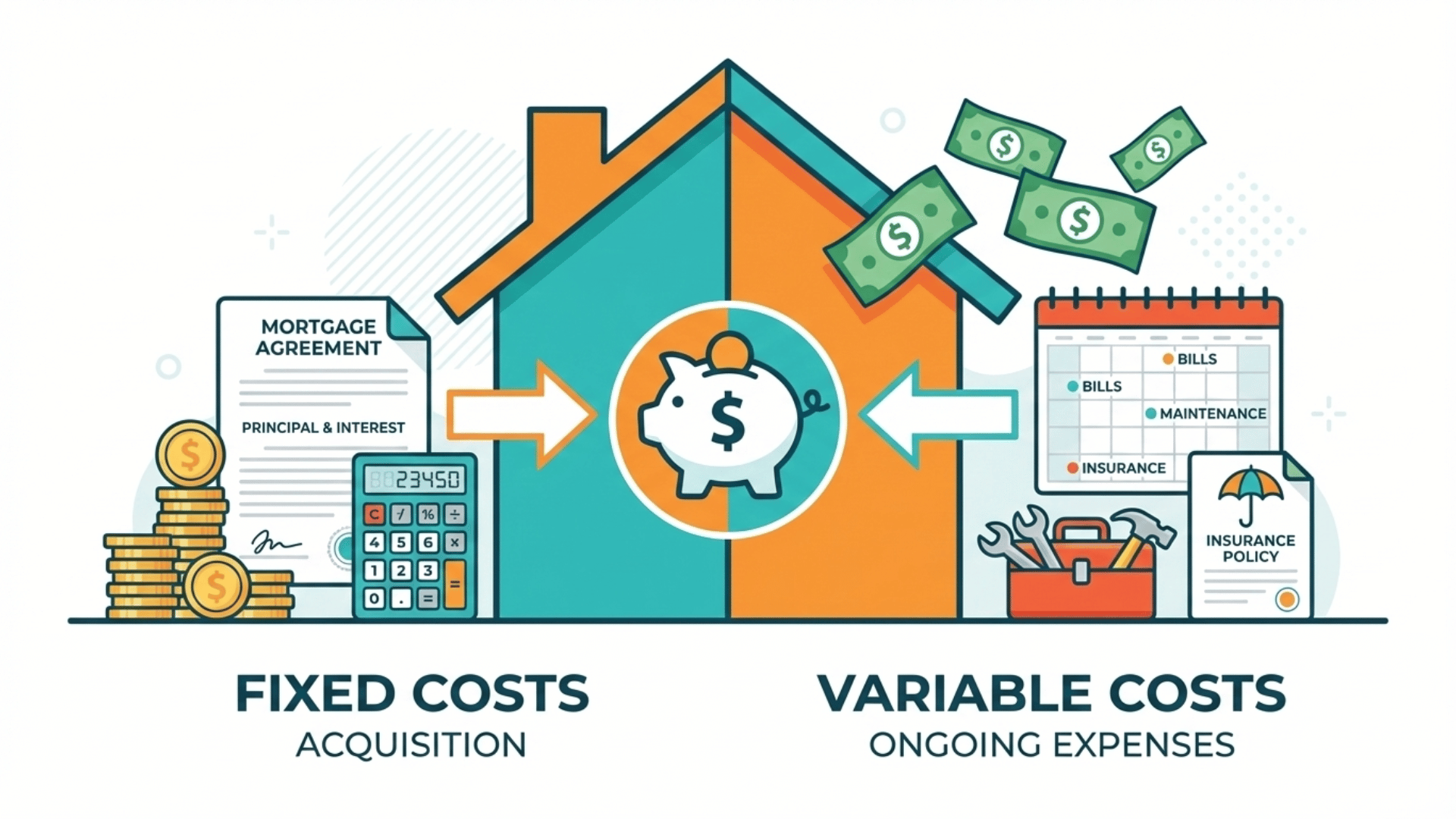

Costs Involved in Shared Ownership

It seems affordable at first glance, but buyers should understand all the costs before committing.

Beyond the initial down payment and mortgage, there are ongoing expenses that differ from standard homeownership.

Initial Costs

- Down payment on the share being purchased (usually 3-10% of the share value)

- Mortgage origination fees and closing costs

- Appraisal, inspection, and title insurance fees

- Homebuyer education course fees (if required)

Ongoing Monthly Costs

- Mortgage payments on the purchased share

- Monthly land lease fee or equity payment to the organization (typically $50-$200)

- HOA or condo fees for maintenance of common areas (if applicable)

- Property taxes (responsibility varies by program structure)

- Homeowners insurance

- Utilities and routine maintenance costs

Buyers should budget carefully because combined housing costs typically aim to stay at or below 30% of gross household income, though this varies by program.

How Building Equity Works in Shared Ownership?

Shared Ownership programs give buyers the flexibility to increase their ownership stake over time, moving toward full ownership at their own pace.

What Is Buying Additional Equity?

Buying additional equity means purchasing larger shares in the property after the initial purchase. Most programs allow buyers to purchase shares in increments of 5-25%, though requirements differ by organization.

The property gets reappraised each time someone wants to buy more equity, so the cost reflects current market prices rather than what was paid originally.

This can work in the buyer’s favor if property values have dropped, but it also means paying more if prices have risen. Some community land trust programs cap appreciation to keep housing affordable for future buyers.

When Can You Buy More Equity?

Buyers can typically start purchasing additional equity after living in the property for at least one to three years, though waiting periods vary by program.

There’s usually no limit on how many times someone can increase their stake.

However, each transaction involves appraisal fees, legal costs, and potential mortgage refinancing fees, so many people choose to buy larger shares less frequently to reduce these expenses.

Some programs require buyers to demonstrate financial stability before approving additional equity purchases.

Reaching Full Ownership

Reaching 100% ownership means the buyer owns the property outright and no longer owes equity to the sponsoring organization.

At this point, they can sell on the open market, though some programs maintain resale restrictions even after full ownership to preserve affordability.

Community land trusts often retain ownership of the land while transferring full building ownership. Once fully owned outside restricted programs, the property becomes subject to standard real estate rules.

The timeline to full ownership varies widely based on individual finances and program structure.

Costs of Increasing Your Stake

Each equity purchase transaction comes with fees that add up quickly. Buyers need a property appraisal (typically $300-$600), legal fees for updating ownership documents, and potentially new mortgage costs if borrowing more.

The sponsoring organization may charge an administrative fee as well, usually $500-$1,500.

Some lenders offer specialized, affordable housing mortgages that accommodate future equity purchases with reduced fees.

Working with the same lender throughout can streamline the process and potentially reduce overall costs compared to refinancing with different institutions each time.

Pros and Cons of Shared Ownership

It presents a mix of benefits and challenges that vary depending on individual circumstances and financial goals.

| Pros | Cons |

|---|---|

| Opportunity to own property without the full market price | Monthly fees add to housing costs beyond the mortgage |

| Can increase ownership by buying more equity over time | Property value appreciation may be capped in some programs |

| Build equity while living in your own home | The selling process may require organizational approval |

| Access to properties in areas otherwise unaffordable | Cannot use the property as a rental without permission |

| Programs often include homebuyer education and support | Responsible for all repairs and maintenance costs |

| Protection from some predatory lending practices | Qualification requirements can be strict |

| Community land trusts provide long-term affordability | May need to sell back to the program at a restricted price |

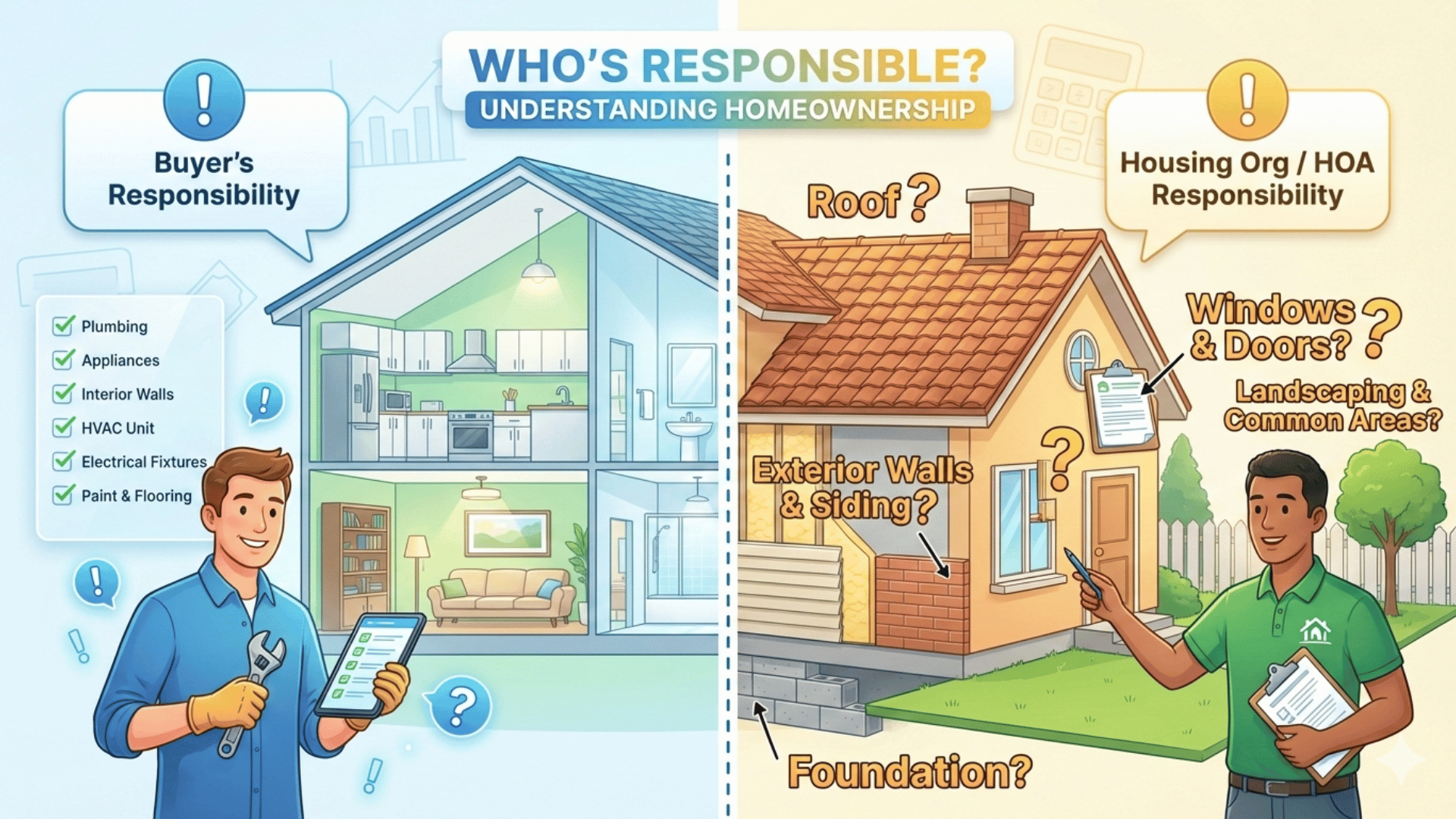

Shared Ownership Rules on Repairs and Maintenance

Ownership comes with responsibilities, and the programs have specific rules about maintenance and costs.

- Buyers are responsible for 100% of interior repairs and maintenance, regardless of the equity share owned

- HOA or condo fees (where applicable) cover common area upkeep and sometimes exterior building maintenance

- Property insurance requirements vary by program, but are typically the buyer’s responsibility

- Some programs require properties to pass annual or periodic inspections

- Buyers should review program documents carefully to understand exactly which repairs fall under their responsibility

- Most programs prohibit major alterations or additions without prior written approval

- Property must be maintained to community standards outlined in the agreement

- Failure to maintain the property properly can result in program violations or forced sale

- Some programs offer emergency repair funds or low-interest loans for major unexpected expenses

How Selling a Shared Ownership Property Works?

Selling a Shared Ownership property involves different steps from a standard sale because the sponsoring organization often retains rights during the process.

Many programs require sellers to offer the property back to the organization first, giving them 30-90 days to find a qualified buyer from their waiting list.

If the organization cannot find a buyer within this period, the seller may list on the open market, though resale price restrictions often apply.

Community land trust properties typically have formulas that limit appreciation to keep homes affordable for the next buyer.

Sellers remain responsible for real estate agent commissions, closing costs, and any outstanding fees owed to the program.

The process can take longer than conventional sales because buyers must meet program eligibility requirements, so anyone planning to move should factor in extra time and potential price limitations when considering their return on investment.

Shared Ownership Vs Traditional Affordable Housing Programs

Understanding the differences between various affordable housing options helps buyers choose the right path for their situation.

| Feature | Shared Ownership | Down Payment Assistance | Community Land Trust |

|---|---|---|---|

| What You Buy | Partial equity share (25-50%) initially | Full property with grant/loan help | Building only; land trust retains land |

| Ongoing Payments | Mortgage plus monthly equity fee | Mortgage only; may repay assistance later | Mortgage plus nominal monthly land lease |

| Who Holds Rest | Nonprofit or housing authority holds equity | The government provides one-time assistance | Trust owns land permanently |

| Increasing Ownership | Buy more equity shares over time | Repay assistance or be forgiven after a set period | Can buy more building equity; never own land |

| Selling the Property | The organization has the first right to purchase | Can sell freely after the assistance repayment period | Must sell to an income-qualified buyer at a restricted price |

| Price Appreciation | May be capped by the program | Full market appreciation | Strictly limited by the resale formula |

| Eligibility Requirements | Income limits and first-time buyer preference | Varies; often for first-time buyers | Income limits and long-term residency commitment |

| Best For | Buyers wanting gradual ownership with support | Those needing a one-time boost to afford a down payment | Buyers committed to community and permanent affordability |

Is Shared Ownership Worth It?

It works brilliantly for some people and proves frustrating for others, so the answer depends entirely on personal circumstances and long-term plans.

It suits buyers who cannot save a large down payment quickly but earn a stable income to cover the mortgage and fees comfortably.

Those planning to stay put for five to ten years and gradually increase their equity often benefit most.

However, people expecting to relocate frequently or hoping for substantial investment returns might struggle with resale restrictions and appreciation caps.

The programs make less sense if monthly costs stretch the budget too thin or if resale formulas significantly limit future profit potential.

Buyers should calculate total costs honestly and understand exactly how resale restrictions work in their specific program.

For those who prioritize stable homeownership over investment gains and have realistic expectations, it provides a genuine path to building equity and community roots that would otherwise remain out of reach.

Conclusion

Shared Ownership opens doors for buyers priced out of traditional markets, but it’s not a one-size-fits-all solution.

The path makes sense if you value stable housing over maximum investment returns and plan to stay put long enough to build meaningful equity.

Calculate your true monthly costs, including that often-overlooked land lease fee, and confirm you’re comfortable with potential resale limitations.

Connect with local housing authorities or community land trusts to explore available programs.