Family Opportunity Mortgage: Benefits and Requirements

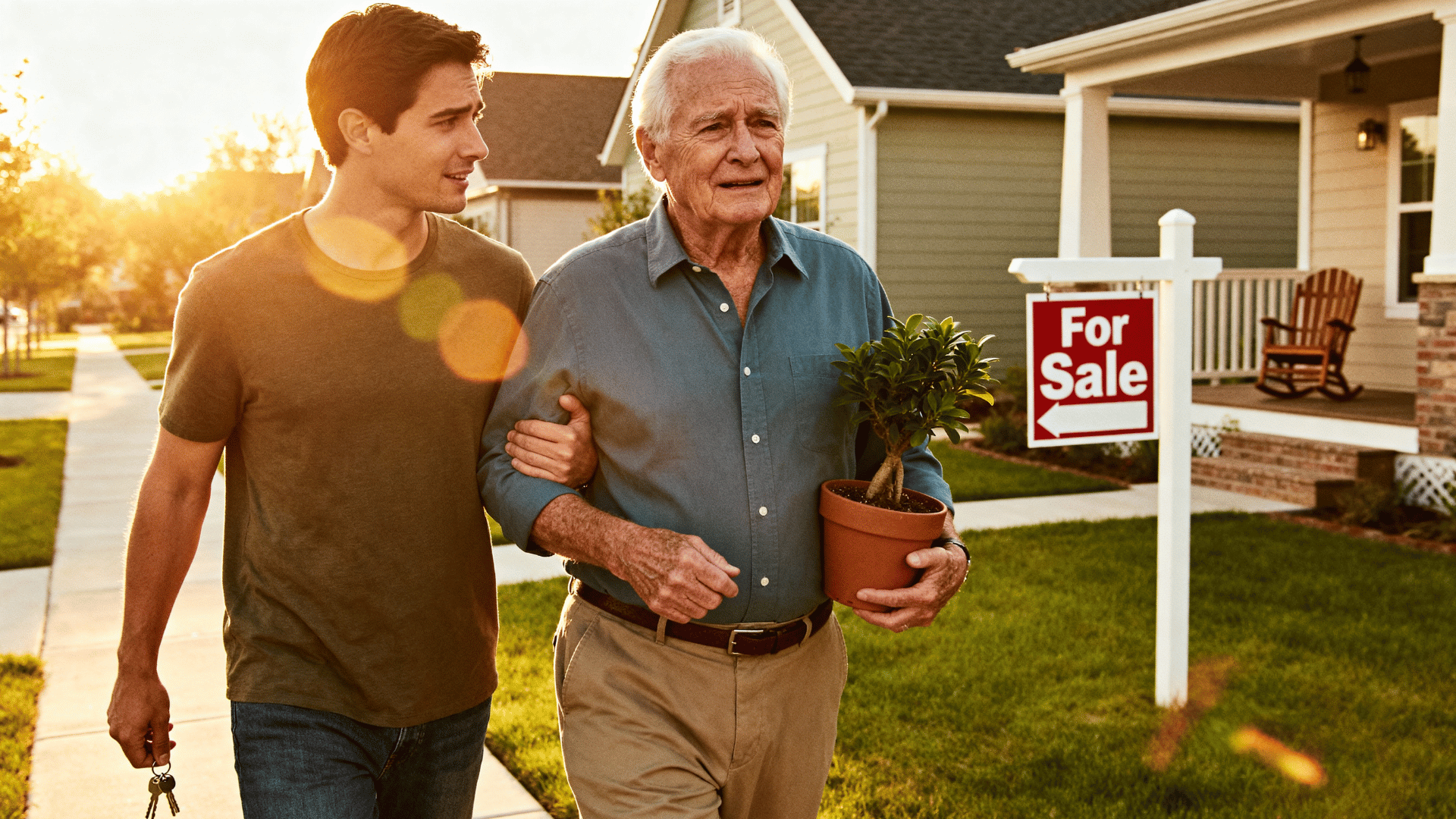

Caring for aging parents or adult children with disabilities comes with financial challenges. Housing them can strain your budget. A family opportunity mortgage offers a solution that many families don’t know about.

It’s designed to help families provide safe, comfortable housing without the typical investment property restrictions.

In this guide, I’ll explain how a family opportunity mortgage works. You’ll learn about the benefits it offers and the requirements you need to meet.

By the end, you’ll know if this option fits your family’s situation.

What Is a Family Opportunity Mortgage and How It Works?

It is a special home loan that lets you buy a house for your relatives. Your parents or adult children with disabilities can live in the property.

But you don’t have to live there yourself. This loan treats the purchase as your primary residence, not an investment property.

That means you get better interest rates and lower down payment requirements.

The way it works is simple. You apply for the mortgage and make the monthly payments. Your family member lives in the home you purchased.

They may or may not contribute to the mortgage costs. Fannie Mae backs these loans, which makes them widely available through most lenders.

The key requirement is that your relative must have a genuine need for your help.

Benefits of a Family Opportunity Mortgage

This mortgage program offers several advantages that make it easier and more affordable to help your family members while building your financial portfolio.

1. Lower Down Payment Options

You can secure this loan with just 5% down in many cases. Traditional investment properties typically require 20% to 25% down.

This lower requirement makes it easier to help your parents or disabled adult children without draining your savings.

2. Better Interest Rates Than Investment Properties

Since this loan is classified as a primary residence purchase, you get residential mortgage rates.

Investment property loans come with higher interest rates, often 0.5% to 0.75% more. Over the life of your loan, this difference saves you thousands of dollars.

3. Tax Advantages for Homeowners

You can deduct mortgage interest on your tax return. Property taxes are also deductible. Plus, you may qualify for depreciation deductions if you follow IRS guidelines.

These benefits reduce your overall tax burden each year.

4. Build Equity While Helping Family

Each mortgage payment builds equity in the property. You’re not just paying rent for your relative. You’re investing in real estate that appreciates over time.

This creates long-term wealth while solving an immediate family need.

5. No Rental Income Verification Needed

Traditional investment properties require rental income documentation and reserves. With a family opportunity mortgage, lenders don’t expect rental income.

Your family member can live there rent-free or contribute informally without affecting your loan terms.

6. Avoid Higher Investment Property Standards

Investment properties face stricter lending requirements and larger cash reserves. You bypass these obstacles with this program.

The underwriting process is similar to buying your own home, making approval more accessible.

Requirements for Family Opportunity Mortgage

Fannie Mae sets strict criteria via Selling Guide to ensure legitimate family use. Lenders enforce these for approval.

Borrower Qualifications

- Credit score: Minimum 620 (640+ preferred for best rates) .

- Debt-to-income (DTI) ratio: ≤45%.

- Stable employment: 2+ years.

- Prove affordability for current home + new mortgage (no rental income from relative).

- Cash reserves: 2-6 months PITI (principal, interest, taxes, insurance).

- Limit: One FOM at a time; maintain separate primary residence.

Family Member Rules

- Parent or adult child with disabilities occupies as primary residence within 60 days of closing.

- Provide letter + docs proving need (e.g., medical/financial for disabilities or aging).

- No ownership interest for occupant; informal contributions OK, but not used for qualification.

Property and Loan Details

- Types: Single-family, townhouse, approved condo; no multi-unit/co-ops/fixer-uppers.

- One-unit max; meets appraisal/inspection standards.

- Down payment: 5-15% (10%+ improves terms); PMI if

- Rates: Primary residence pricing (0.5-0.75% below investment); fixed/ARM options.

- Other: No owner occupancy ever; standard insurance; conforming loan limits ($766,550 high-cost areas, 2026) .

Down Payment and Interest Rate Rules

The down payment and interest rate structure for a this differs significantly from traditional investment properties, making it more accessible for families.

Down Payment Requirements

You’ll need a minimum down payment based on your loan-to-value ratio. Most lenders require at least 5% down for these mortgages.

However, putting down 10% or more can improve your loan terms. If you put less than 20% down, you’ll pay private mortgage insurance until you reach 20% equity.

Some lenders may require 15% down depending on your credit profile and the property value.

Interest Rate Structure

- Rates are based on primary residence pricing, not investment property rates

- Your credit score heavily influences the rate you receive

- Current market conditions affect your interest rate like any conventional loan

- A larger down payment can help you secure a lower interest rate

- Rate locks are available for 30 to 60 days during your home search

- Fixed-rate and adjustable-rate options are both available

- Expect rates comparable to what you’d get buying your own home

The combination of lower down payments and competitive rates makes this program financially viable for many families.

Eligible Property Types for Family Opportunity Mortgage

The type of property you can purchase under this program has specific restrictions to ensure it meets the intended purpose of housing a family member.

- Single-family detached homes are the most common and widely accepted property type

- Townhouses and row houses qualify if they meet condominium project requirements

- Condominiums must be on Fannie Mae’s approved condo project list

- Manufactured homes may qualify if they meet specific foundation and land ownership criteria

- Multi-unit properties are generally not eligible for this program

- The property must be located in an area where conventional loans are available

- Co-ops and properties with shared ownership structures typically don’t qualify

- The home must meet standard livability and safety requirements

- Properties in rural areas may have additional eligibility considerations

- Fixer-uppers requiring major renovations usually won’t qualify until repairs are complete

Step by Step Process to Apply

Getting it involves several steps that ensure you meet all requirements and properly document your family’s situation.

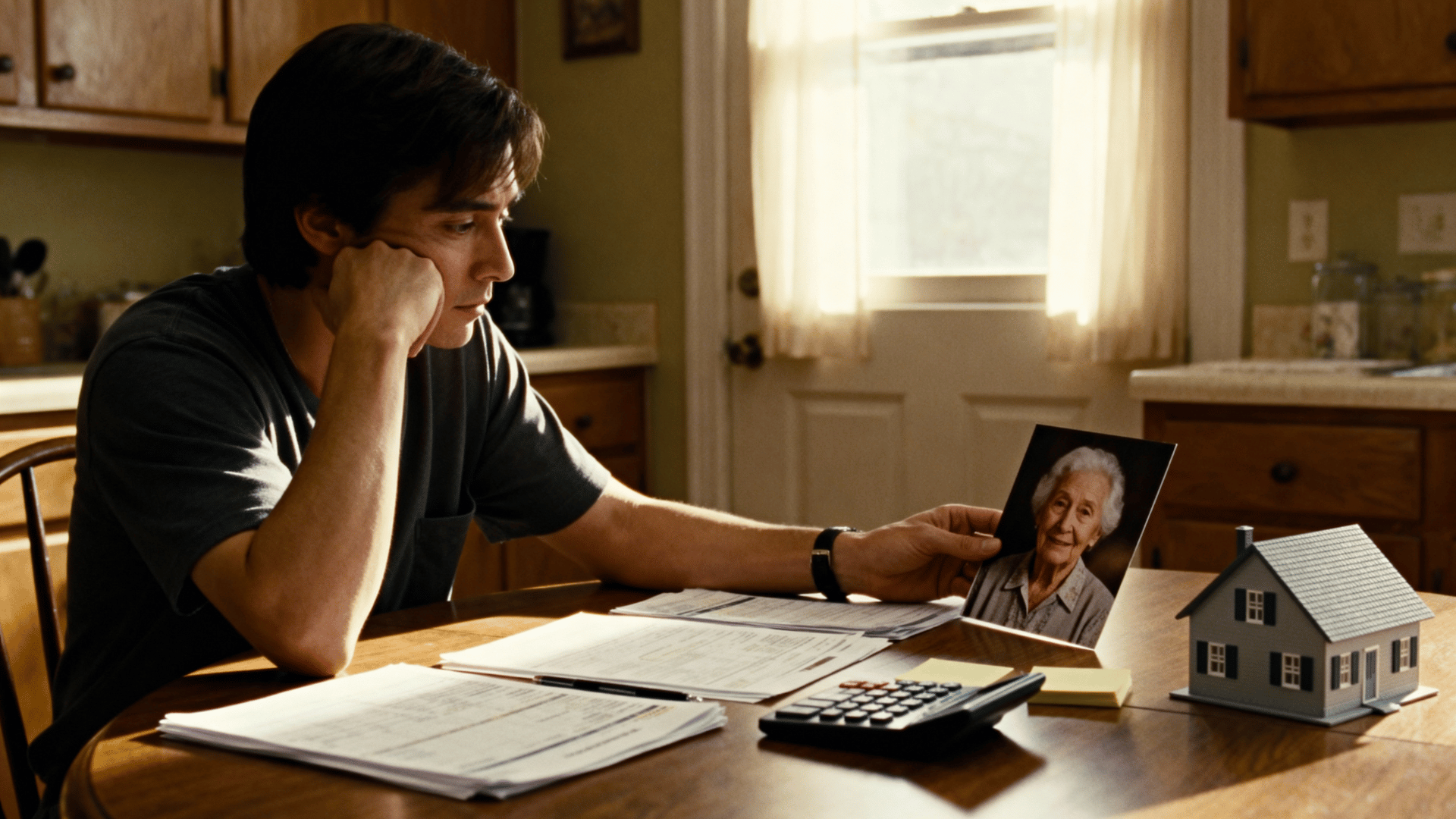

Step 1: Check Your Financial Readiness

Start by reviewing your credit report and score. You need at least 620, but higher scores get better rates. Calculate your debt-to-income ratio by adding all monthly debt payments and dividing by your gross monthly income.

Make sure you have enough savings for the down payment, closing costs, and reserves. Lenders typically want to see two to six months of mortgage payments in reserves.

Step 2: Get Pre-Approved by a Lender

Contact lenders who offer family opportunity mortgages and submit your financial documents. You’ll need pay stubs, tax returns, bank statements, and employment verification.

The lender will review your finances and issue a pre-approval letter. This letter shows sellers you’re a serious buyer with financing in place.

Step 3: Prepare Documentation for Your Family Member

Write a letter explaining why your relative needs housing assistance. Include medical documentation if your adult child has disabilities.

For elderly parents, describe their financial or health situation that requires your help. This documentation proves the legitimate need for this special mortgage program.

Step 4: Find and Make an Offer on a Property

Work with a real estate agent to find a suitable home in your price range. The property must meet the eligible types outlined earlier.

Once you find the right home, submit an offer. Your agent will help negotiate terms with the seller.

Step 5: Complete the Mortgage Application Process

Submit your full loan application with all required documents. The lender will order an appraisal to confirm the property value.

They’ll also verify your employment and review your financial situation again. Answer any questions promptly to keep the process moving smoothly.

Step 6: Close on Your New Property

Review all closing documents carefully before signing. You’ll pay your down payment and closing costs at this time. Once everything is signed, you’ll receive the keys.

Your family member can move in within 60 days as required by the loan terms.

Common Mistakes to Avoid

Many borrowers make errors during the application process that can delay approval or lead to loan denial, so knowing what to avoid helps ensure a smooth experience.

- Failing to disclose the occupancy arrangement upfront to your lender from the start

- Trying to claim rental income from your family member on the loan application

- Not maintaining your own separate primary residence while owning this property

- Forgetting to gather proper documentation about your relative’s need for assistance

- Applying for multiple family opportunity mortgages at the same time

- Assuming all lenders offer this program without checking their specific guidelines

- Making large purchases or opening new credit accounts during the application process

- Not budgeting for ongoing expenses like property taxes, insurance, and maintenance costs

- Choosing a property type that doesn’t meet Fannie Mae eligibility requirements

- Waiting until after closing to inform your family member about the 60-day move-in requirement

- Neglecting to save adequate reserves beyond just the down payment amount

- Misrepresenting your relationship with the occupant or their actual need for help

Is a Family Opportunity Mortgage Right for You?

It makes sense if you have the financial stability to manage a second mortgage payment. You need a genuine family situation where your parent or adult child with disabilities requires housing help.

The program works best when you can afford the property even if your relative doesn’t contribute financially.

Consider your long-term plans before applying. Will your family member need this housing for several years?

Can you handle two mortgages if your financial situation changes? Do you have enough reserves for unexpected repairs or vacancies?

This loan is ideal for families who want to keep loved ones close while maintaining separate households. It’s also smart for those who see the value in building equity rather than paying rent for a relative.

If you meet the credit and income requirements, and your family has a legitimate need, this program offers a practical solution. Talk to a mortgage lender to see if your specific situation qualifies.

The Bottom Line

A family opportunity mortgage gives you a practical way to support your loved ones while building your investment portfolio.

You get favorable loan terms, lower down payments, and better interest rates than traditional investment properties. Your parents or adult children receive safe housing, and you gain real estate equity.

Before you apply, make sure you understand the requirements and can handle the financial commitment.

Ready to help your family while making a smart financial move? Start by getting pre-approved and exploring your options today. Your family’s future could be just one application away.