Clear to Close Meaning in the Mortgage Process

Getting a mortgage approved is exciting, but the process can feel confusing. One term that often leaves homebuyers scratching their heads is “clear to close meaning.”

It’s a critical milestone, yet many people aren’t sure what it actually means or what happens next. Understanding this phase can save stress and prevent last-minute surprises.

This blog breaks down the clear-to-close meaning in simple terms, explains what to expect during this stage, and guides homebuyers through the final steps before closing day.

By the end, you will know exactly what “clear to close” signals and how to prepare for a smooth finish to their home purchase.

Clear to Close Meaning in Mortgage Lending

Clear to close meaning refers to the stage when a lender has reviewed all documents, verified financial information, and confirmed that a borrower meets every requirement for a mortgage loan.

It’s essentially the green light that tells everyone involved the loan is ready to move forward to closing. At this point, the underwriter has finished their review and found no remaining issues or conditions that need addressing.

Homebuyers receive official notification, often through their loan officer, that they’ve reached this milestone. However, it doesn’t mean the deal is completely done yet.

There are still a few final steps before the borrower gets the keys to their new home. But reaching a clear close is a major achievement and signals that closing day is just around the corner.

How Does the Clear to Close Stage Work?

The stage begins after the underwriter completes a thorough review of all loan documents and verifies that every condition has been satisfied.

This process involves checking income documentation, credit reports, appraisals, and title work. Once everything checks out, the file moves to a final quality control review.

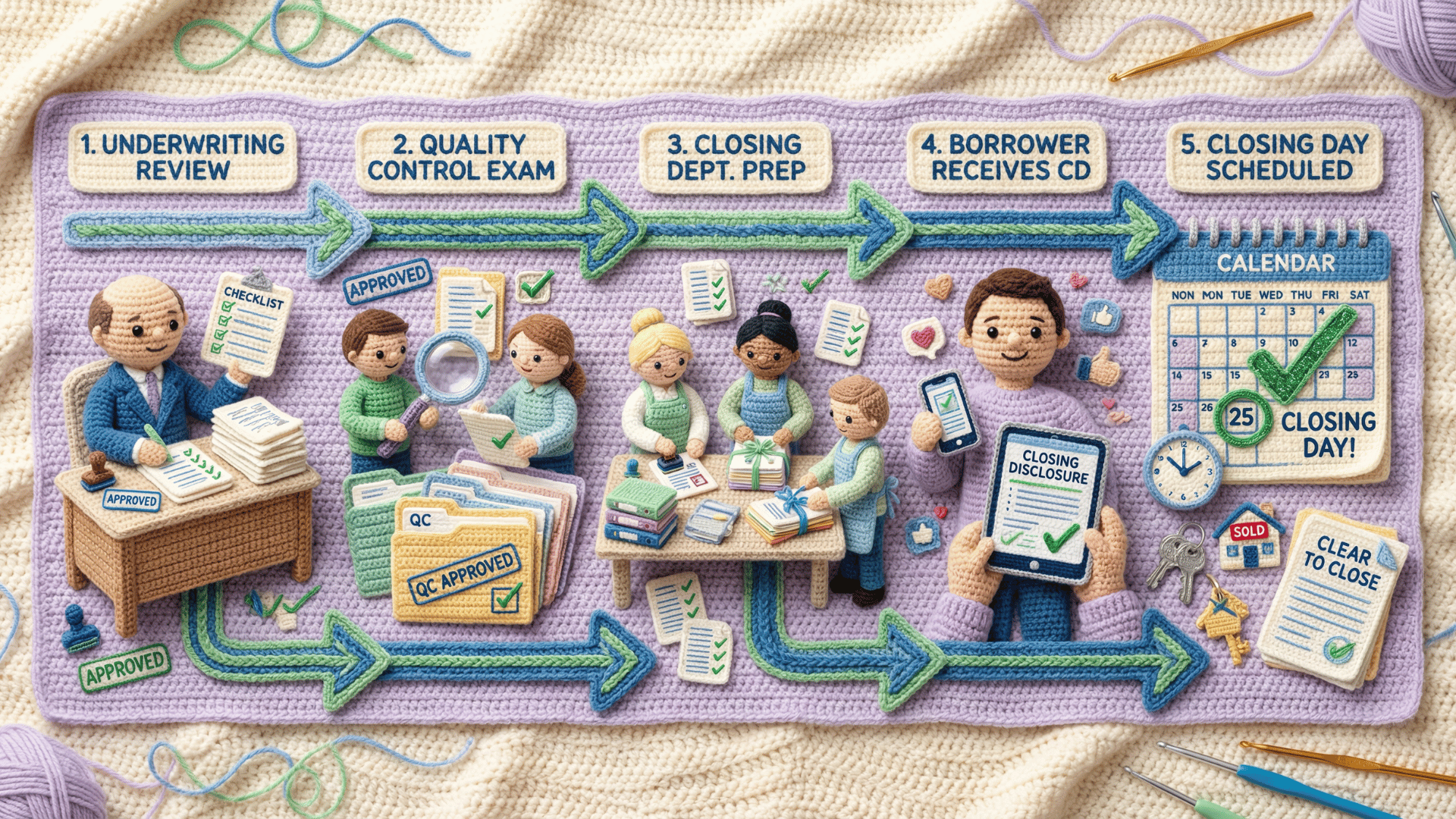

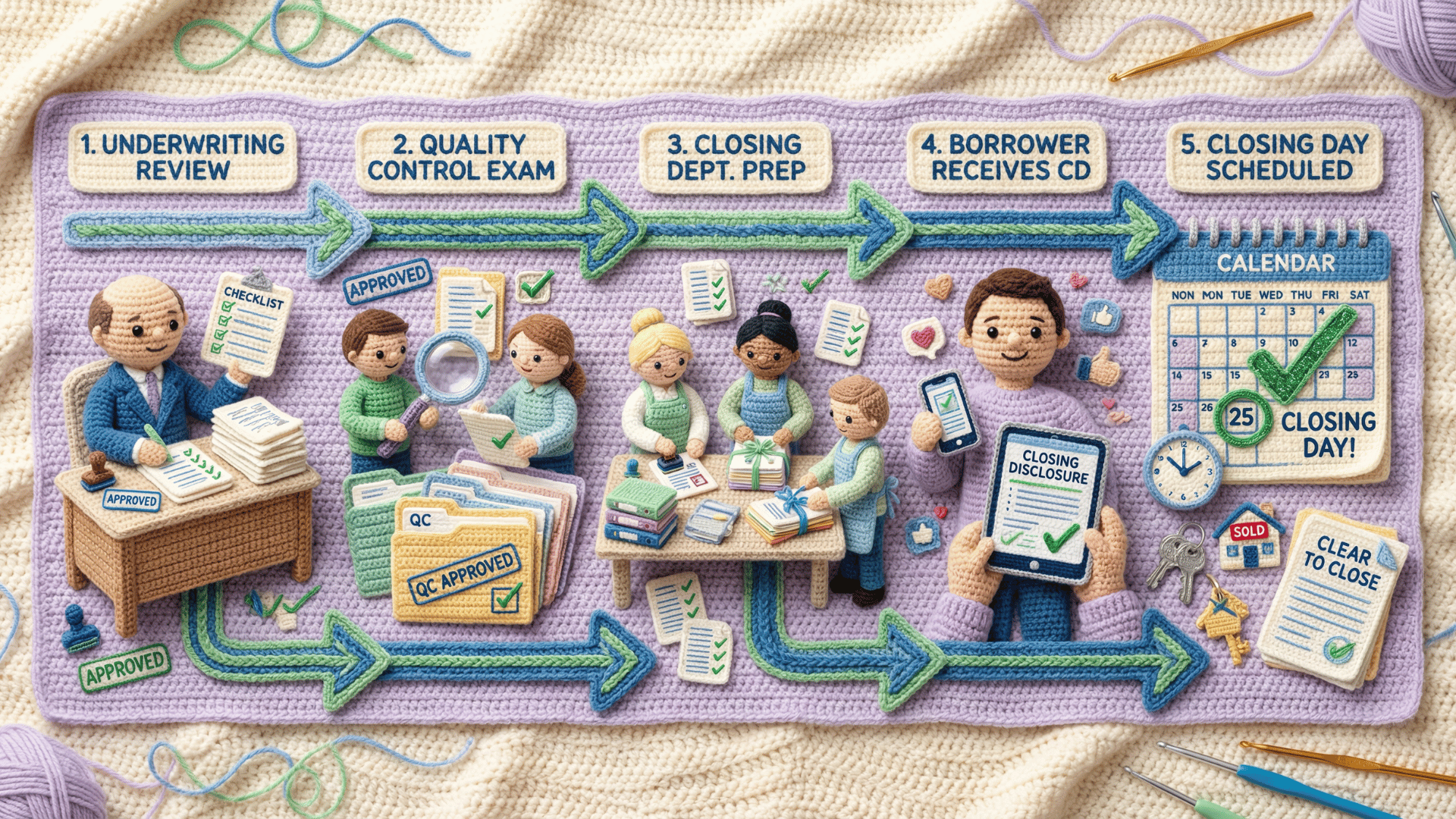

Here’s What Typically Happens During This Stage:

- The underwriter signs off on the loan file and removes all outstanding conditions

- The lender’s quality control team performs a final review to catch any errors

- The closing department prepares final documents and coordinates with the title company

- The borrower receives a Closing Disclosure, which outlines final loan terms and closing costs

- A closing date gets scheduled, and all parties prepare for the final signing

Clear to Close Vs Final Loan Approval

Many people think final loan approval and clear to close mean the same thing, but they don’t.

Understanding the difference between these two stages helps borrowers know exactly where they stand in the mortgage process.

| Aspect | Final Loan Approval | Clear to Close |

|---|---|---|

| Timing | Happens earlier in the process | Comes after final approval |

| What it means | Underwriter approves the loan with conditions | All conditions are met and verified |

| What’s left | The borrower must satisfy the remaining conditions | Only final paperwork and closing remain |

| Documents | Initial approval letter issued | Closing Disclosure sent to borrower |

| Risk level | Still some chance of issues arising | Very low risk of problems |

| Next steps | Submit additional documentation | Review closing documents and schedule the closing |

Final loan approval means the lender likes what they see but needs a few more items. Clear to close means everything is complete and verified.

Why Clear to Close Is Important for Borrowers?

Clear to close represents more than just another step in the mortgage process. It’s a pivotal moment that impacts everything from moving plans to financial peace of mind, offering several key advantages.

- Confirms the loan will fund and the home purchase can proceed

- Allows borrowers to finalize moving plans with confidence

- Reduces anxiety about potential loan denial

- Signals that employment verification and credit checks have passed

- Enables borrowers to schedule utility transfers and changes of address

- Gives real estate agents and sellers assurance that the deal will close

- Allows borrowers to prepare financially for closing costs

- Marks the final countdown to homeownership

Steps Required to Get Clear to Close

Getting the stage requires completing several important steps throughout the mortgage process. Each one builds toward final approval.

1. Submit a Complete Loan Application

The process starts with filling out a detailed loan application that includes information about income, assets, debts, and employment history.

Borrowers need to provide accurate information and be ready to explain unusual financial circumstances. Lenders use this information to determine if the borrower qualifies for the requested loan amount.

2. Provide Financial Documentation

Lenders require proof of income through pay stubs, W-2 forms, and tax returns. Self-employed borrowers typically need two years of tax returns and profit and loss statements.

Bank statements showing assets for the down payment and reserves are also necessary. The lender verifies that all funds are properly sourced and seasoned.

3. Complete the Home Appraisal

An independent appraiser evaluates the property to ensure it’s worth the purchase price. The appraisal protects both the lender and borrower from overpaying.

If the appraisal comes in low, it can create issues that need resolving before moving forward.

4. Satisfy All Underwriter Conditions

After the initial review, underwriters often request additional documentation or explanations. Borrowers must respond quickly and provide whatever is asked.

Common requests include letters of explanation for credit inquiries, proof of deposit sources, or updated pay stubs. Satisfying these conditions promptly keeps the process moving.

5. Pass Final Verification Checks

Right before clear to close, lenders perform final verification of employment and credit. They want to confirm nothing has changed since the initial approval.

Borrowers should avoid making any major financial moves during this time, as changes can delay or derail the loan.

What Happens After You Are Clear to Close?

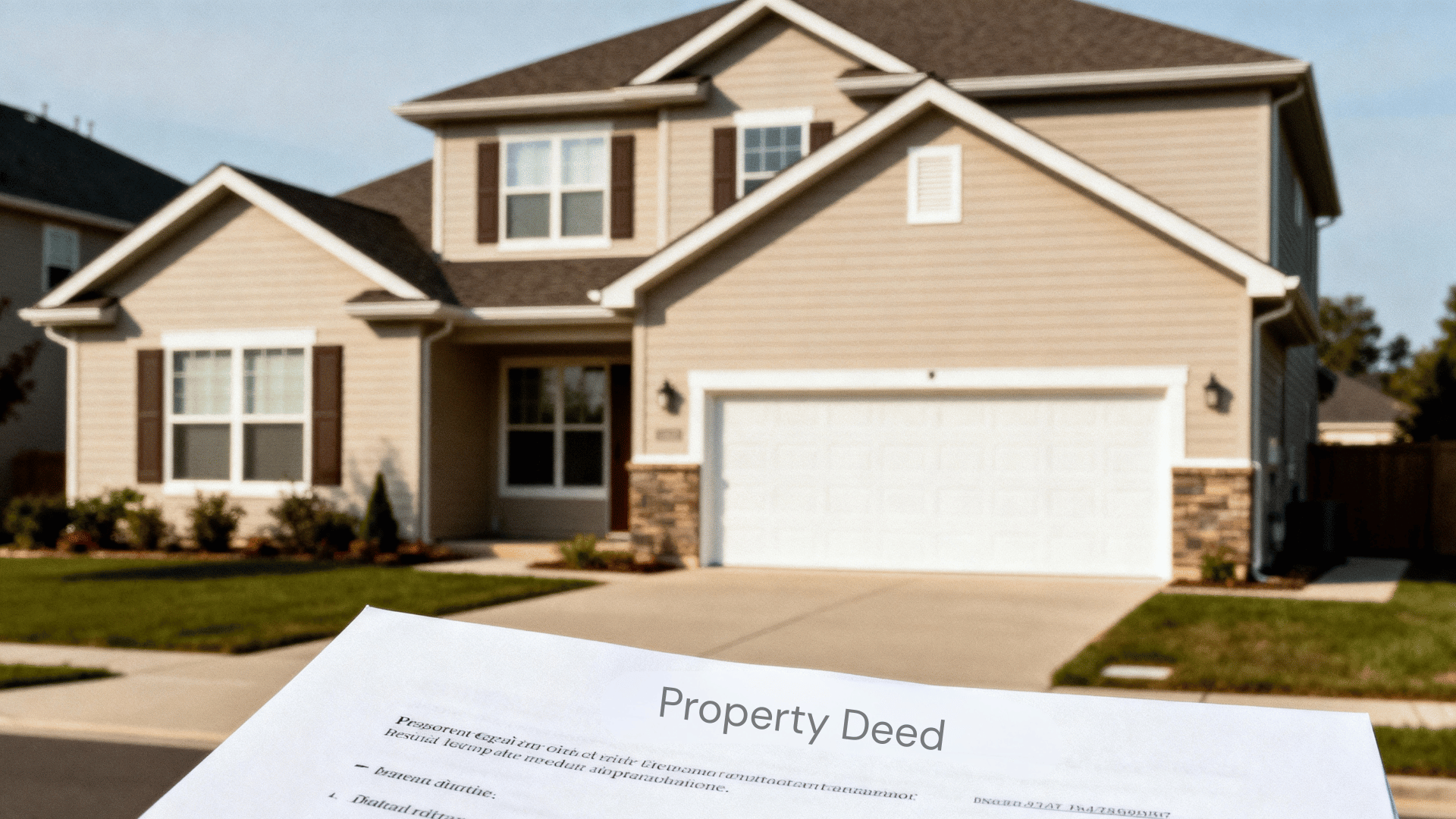

Once a borrower receives a clear to close status, the process shifts into its final phase. The lender prepares the Closing Disclosure, which must be delivered at least three business days before closing.

This document outlines the final loan terms, the monthly payment, and the closing costs. Borrowers should review it carefully and compare it to their initial Loan Estimate.

During this waiting period, the title company conducts a final title search and prepares closing documents. The lender also arranges for the loan funds to be available.

How long after clear to close until closing? Typically, it takes three to seven days.

The three-day waiting period after receiving the Closing Disclosure is mandatory, but scheduling and coordination with all parties can extend the timeline a bit longer.

Can a Loan Fall Through After Clear to Close?

Although reaching a clear close is a positive sign, loans can still fall through at this late stage. It’s rare, but certain situations can derail a mortgage even after getting the green light.

- Borrower makes a large purchase or opens new credit accounts

- Job loss or significant income reduction occurs

- Borrower’s credit score drops due to late payments

- Property damage happens before closing (fire, flood, etc.)

- Title issues are found during the final title search

- Borrower withdraws large amounts of cash without explanation

- Final walk-through reveals property damage or incomplete repairs

Mistakes to Avoid After Clear to Close

Reaching clear to close is exciting, but it’s not the time to let your guard down. Certain financial moves during this final period can still derail your mortgage and cost you the home.

- Making large purchases like furniture, cars, or appliances

- Opening new credit card accounts or applying for other loans

- Changing jobs or switching to self-employment

- Moving money between bank accounts without documentation

- Missing any bill payments or letting accounts go late

- Co-signing loans for friends or family members

- Making large cash deposits that can’t be properly sourced

- Closing credit card accounts, which can affect credit scores

- Taking on any new debt or financial obligations

Conclusion

Understanding clear to close meaning puts homebuyers in control of the final stretch of their mortgage process. Now that the term makes sense, borrowers can approach this stage with confidence instead of confusion.

Avoid unnecessary purchases, keep credit accounts steady, and respond quickly to any last-minute requests.

This knowledge changes what once seemed like mortgage jargon into a clear roadmap for success. Homeownership is within reach at this point, and staying focused for just a few more days ensures a smooth closing.

Remember, clear to close isn’t the finish line, but it’s the final turn before reaching it.